Hybrid Funds – fusion of volatility and stability

Nishant Batra – Research Head

Before October’2017, most of the AMCs were running multiple schemes which were too similar in strategy and in portfolio. It made the job of retail investor tougher to choose from non-standardised mandates. SEBI came up with “Categorization and Rationalization of Mutual Fund Schemes”:

- to clearly distinct the schemes in terms of asset allocation, investment strategy, etc.

- to bring in uniformity in the characteristics of similar type of schemes launched by different Mutual Funds.

- investor is able to evaluate the different options available, before taking an informed decision to invest in a scheme.

The Schemes were classified in the following groups:

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution Oriented Schemes

- Other Schemes (Index Funds / ETFs / Fund of Funds)

This categorization is applicable to open ended schemes only (and not to closed ended or interval schemes).

Today, in this article we will discuss about Hybrid Schemes.

There are mutual fund schemes which invests in Equity (group #1). Then there are mutual fund schemes which invests in debt (group #2). AND there are mutual fund schemes which invests in a combination of both – combination of volatility and stability, known as hybrid schemes (group #3). In hybrid funds, there can be more than two asset classes (apart from equity and debt) like gold and real estate.

Volatility for higher returns and stability for lower drawdowns, that’s the whole premise of hybrid funds.

Before moving further, let’s understand one of the onlydeterminants for taxation of Mutual Funds. Mutual funds for taxation purposes are categorized as:

- Equity-Oriented Mutual Funds: Mutual fund schemes investing 65% or more of net assets in domestic listed equity are classified as equity oriented mutual fund schemes. Moreover, the formula to calculate gross exposure is by taking average of twelve months and in every month first and last business days are considered i.e. average of twenty-four data points. Here noteworthy point is 65% is gross exposure, meaning if scheme has bought shares in spot market and have sold the respect futures (arbitrage position), it will be included in equity exposure to calculate the threshold limit of 65%.

- Non-Equity-Oriented Mutual Funds: All other schemes except for those described in (1) above.

Different Types of Hybrid Funds:

Arbitrage Funds:

It’s important to understand how arbitrage funds work. Arbitrage funds make money by parking the funds in arbitrage opportunities i.e. buying stocks in spot market and selling their respective futures at some premium. This gap between the spot market and future market is called spread.

In Arbitrage Funds, turnover ratio is very high and transaction costs (like brokerage, Security Transaction Tax, etc) eats away a major portion of returns.

Spreads are mainly dependent on interest rates in the market. Spreads also fluctuate with the volatility in the market and may also turn negative. In march’2020, due to compression of spreads, Tata AMC and ICICI AMC temporarily halted the inflows.

Before the SEBI recategorization, some of the arbitrage funds were having a small portion of unhedged equity as well to boost returns.

Here, the AMCs have to mandatorily invest at least 65% in arbitrage opportunities of equity and hence taxation of all arbitrage funds is that of equity oriented mutual funds. AMCs invest the remaining portion in debt.

The most important thing investors should keep in mind before zeroing in on any arbitrage fund is to check the debt portion of the scheme. Look for credit risk and interest risk in this portion. Go for AAA/Sovereign/A1+ debt portfolio with maturity of less than a year.

In the equity portion, as funds are fully hedged, breakup of Large cap, Midcap and Small cap doesn’t matter.

Ideally, one should not use arbitrage funds for very short periods of time, let’s say one month. The reason is in settlement cycle. Being equity oriented, redemptions proceeds from arbitrage funds get credited to account on T+3 basis. And if you have redeemed on Wednesday, Thursday or Friday, this cycle will become T+5. Liquid funds are much better for short term parking of funds.

Arbitrage fund can be used in goal-based planning to park a part of emergency funds or for goals which are less than 3 years away.

Conservative Hybrid Fund

The mandate in this category is to invest 10% to 25% of the total assets under management in equity and 75% to 90% in debt. Schemes are also allowed to invest up to 10% in REITs and InvITs.All the funds are following similar asset allocation mandates.

Before the SEBI’s recategorization, these funds were more popularly known as Monthly Income Plan.

Similar to the filters for arbitrage funds, investors must check the debt portion of the scheme. Look for credit risk and interest risk in this portion. The problem is even if you choose the best suited portfolio (as per market outlook) at the time of purchase, there is no guarantee that scheme will stick to the portfolio because there are no “ranges” of taking interest rate risk or credit risk.

To give you examples of credit risk, Franklin, Nippon and UTI had previously created segregated portfolios in their conservative hybrid schemes. So, please don’t go by name, that it is a conservative scheme. Nippon has two segregations, one of Yes Bank and one of Idea.

On the other hand, if investor chooses a pure debt portfolio, he is aware of the strategy and the “range” of interest rate and credit risk.

In the equity portion, breakup of Large cap, Midcap and Small cap should also be considered. Concentration, sector breakup, strategy adopted and experience of fund manager should also be considered. Larger the portion of small cap and more concentrated the equity holdings (by company, group or sector), riskier it is.

Taxation of all conservative hybrid funds is of non-equity oriented mutual funds.

NAV Rebased to 100 on 01st Jan’2019 – FPA

I do not find any place for this category in any of the portfolio.

Aggressive Hybrid Fund

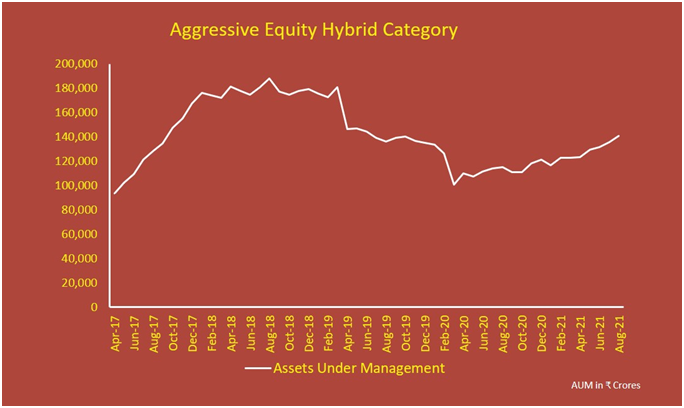

The mandate in this category is to have 65% to 80% of total assets in equity and 20% to 35% in debt. It is one of the most popular categories in hybrid group having AUM of ~ ? 1.41 lakh crores

Before the SEBI’s recategorization, these funds were more popularly known as Balanced Funds.

It was also one of the most mis-sold categories by showcasing the track record of dividends.

These funds are best suited for most of the investors. The power of rebalancing does a magical job in delivering risk adjusted returns.

Similar to the conservative hybrid funds, Nippon was caught on the wrong foot, result, two side pocketing, Yes Bank and Idea. Again, I would like to reiterate, the debt portion has to be scanned like an antivirus scans your laptop.

As this category was highly mis-sold by relationship managers of private sector banks to covert their Fixed Deposit customer into a “balanced fund” investor. It just took one year of flat returns for the AUM to flow out like from a cracked bucket.

If someone ask me to name only one fund portfolio, then that fund will come from this category. This category can be used by moderate and aggressive risk profile investors to plan for their long term goals.

Aggressive Equity Hybrid Category – FPA

Balanced Hybrid Fund

The mandate in this category is to have 40 to 60% of the AUM in Equity and 40% to 60% in debt.Arbitrage positions are not permitted in this scheme.

AMCs can either launch Aggressive Hybrid Fund or Balance Hybrid Funds.

Due to the non-equity taxation of balance hybrid funds and popularity of aggressive hybrid funds, AMCs are interested only in launching Aggressive Hybrid Funds.

As on 31st August there are a total of 34 AMC which are offering aggressive hybrid fund but no AMC has any offerings in balanced hybrid fund and I am quite sure we will not see any offering in here. In fact, SEBI should rejig this category, make it tax efficient and remove the either-or condition OR completely remove this category (any which ways there are no funds over here).

Dynamic Asset Allocation orBalanced Advantage Funds

This category of funds, allow the AMC to dynamically manage the equity and debt portion in the scheme. By regulation, there is no range for equity and debt. AMCs present their own investment strategy to investors by giving range of equity and debt.

This allocation is based on the proprietary model of the AMC based on technical indicators like momentum, moving averages, etc or fundamental indicators like Price to Earnings, Price to book, etc. or combination of both technical and fundamental indicators.

There are three kind of Balanced Advantage Funds/Dynamic Asset Allocation funds out there, pro-cyclical(like Edelweiss Balanced Advantage), counter-cyclical (ICICI Balanced Advantage, DSP Balanced Advantage and many more) and static asset allocation (HDFC Balanced Advantage).

There is a saying that the trend is your friend and you can make more money following the trend than going against it. Some funds(like Edelweiss BAF) follow the trend in different market cycles. The main principle is to increase the equity exposure in bull market and reducing exposure in bear market. Here the strategy is to buyhigh and sell higherThis asset allocation strategy is pro-cyclical.

Investors put more money in stocks in bull markets, irrespective of valuations and pull money out of stocks in bear markets. Therefore, valuation-based asset allocation strategy is contrarian or you can say against the trend. Here the funds try to buy low and sell high. Hence this strategy is known as counter-cyclical.

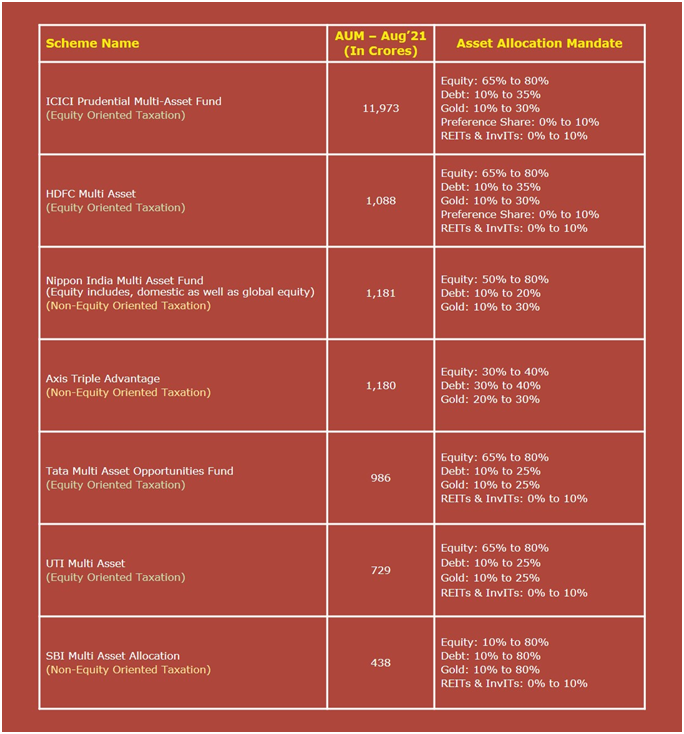

Multi Asset Allocation

This category of funds invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes. Regulator has explicitly said that international equity will not be considered as separate asset class.

Here the taxation has to be seen at individual scheme level, as different schemes are following different mandates.

Asset Allocation Mandate – FPA

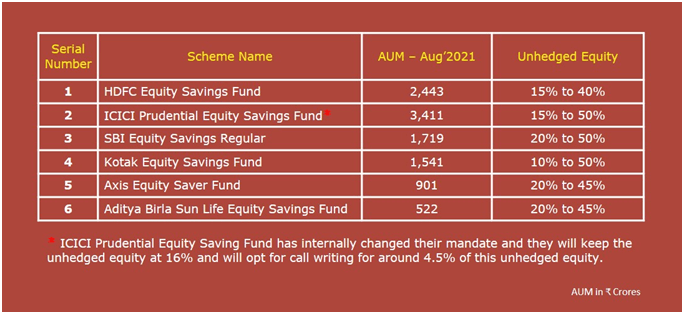

Equity Savings Fund

It is an equity-oriented taxation hybrid category and gross equity exposure is 65% or more. Unhedged equity portion is brought down by derivative positions and every scheme has defined their mandate in their respective Scheme Information Document.

ICICI Prudential Equity Saving Fund – FPA

Before the implementation of LTCG in January’2018, these schemes were popular among conservative HNIs, as the debt portion of the returns were also expected to be tax free. But once the LTCG was implemented on equities, this category started losing its sheen.

AUM of HDFC Equity Savings was ~ 6750 Crore in Jan’2018 and in Aug’2021 its ~ 2440 Crore. Inspite of 7 new launches since Jan’2018, category as a whole has lost around 40% of the AUM (some portion of the fall in AUM has got absorbed due to rise in the value of overall market).

In September’2019, category witnessed it’s first segregation. Reliance Capital NCD were there in Nippon Equity Savings Fund. It reinstates the previously said principle, always always double check the debt portfolio of hybrid funds. There are loose mandates and can result in partial loss of capital. After the change in management, now Nippon is doing exceptionally well.

Advantages & Disadvantages of investing in Hybrid funds:

1. Pass through of taxation but at higher cost:

The biggest advantage of investing in hybrid funds is pass through of taxation. All the rebalancing between equity and debt do not trigger any taxation. If investors keep the debt and equity separate and do the rebalancing on their own, it triggers capital gains and hence cash out flow in the form of taxes.

As per a report titled “Global Investor Experience Study: Fees and Expenses” prepared by Morningstar in 2019, the TER of debt is comparatively cheaper than equity. But in a hybrid fund, the cost of managing debt increases significantly.

Global Investor Experience Study – FPA

2. Rebalancing of asset classes but can’t plan sub-asset classes allocation

Rebalancing in hybrid funds is free from any behavioural biases and AMC keep doing it for you. If you are managing your debt and equity separately, you have to keep a track of the overall asset allocation and rebalance whenever weight deviates.

Through hybrid funds, it’s very difficult to allocate in sub-asset classes. For example, if you have a view that small cap will do better than the large caps you may not be able to find a hybrid fund which is heavy on allocation in small cap. Similarly, interest rate sensitivity, credit risk, value or growth strategy, sectoral calls … it’s difficult to play through hybrid funds.

3. Protects downside but won’t capture the upside equivalent to frontline index in short run

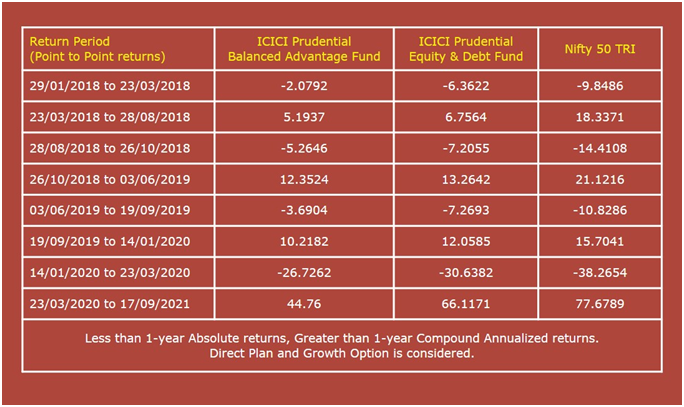

If we look at the performance frontline index compared with balanced advantage fund and equity hybrid fund from same AMC. It will be clear that they have fallen less than frontline indices. Here are some of the instances:

Return Period – FPA

Clearly, the drawdown in BAF < Equity Hybrid < Frontline Index on all the occasions.

Below is the comparison of other BAFs with Nifty, you can clearly see, in the short run, BAFs have not been able to capture the full upside as compared to index but were able to protect the downside.

Return Period – FPA

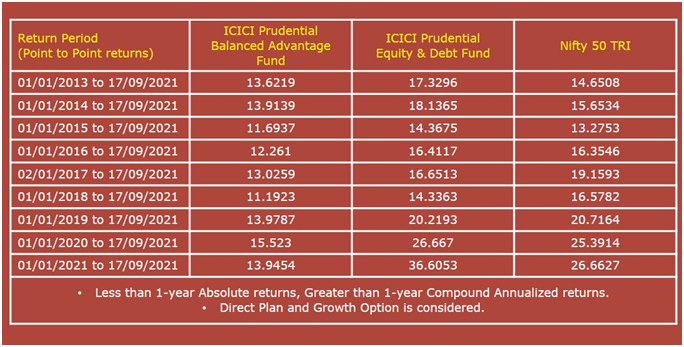

Many of you guys will say that, I should compare returns in the longer run. So, below is the comparison, I have taken, random start dates, from first trading day of each calendar year. I have started from 2013 as direct plans were available from that date.

Return Period – FPA

On the longer time frame of 5 to 7 years, BAF has under-performed the index by small margin (but have smoothen the journey). On most of the occasions, equity hybrid fund has beaten the index.

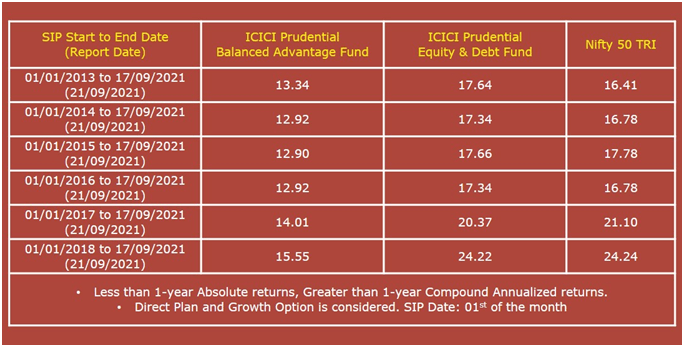

Ok, you guys also want to see comparison of SIP returns.

SIP Start To End Date Report – FPA

4. Active Vs. Passive

Investors who want to build a low-cost passive portfolio, do not have any options available in hybrid funds. Smart investors are desperately waiting for an offering which can is low cost, passive and provides a tax efficient wrapper.

SEBI can consider converting the Balanced Hybrid category, where no AMC has launched any fund yet. AMCs can come up with 80:20, 70:30 Equity Debt kind of option, with static allocation, month end rebalancing (or any other rule driven rebalancing).

Also, there are no tax saving ELSS in hybrid category.

5. Reduces Panic and keeps you invested for longer periods of time. Won’t give the highest returns

Hybrid funds smoothens the volatility but never will they able to deliver returns like a thematic fund or mid/small cap fund (timed well).

Below is the explanation of BAF/DAAF models of leading AMCs

ICICI Prudential Balanced Advantage Fund:

ICICI is running one of the biggest funds by AUM in this category ~ 34600 Crore. Their approach is counter cyclical, i.e. buy low and sell high. Their proprietary model is based on longterm historical mean Price to Book Value (P/BV), which aims to increaseequity exposure when valuations are attractive and aims to reduce equityexposure when valuations are expensive. The scheme is market cap agnostic for equity allocation and in debt allocation fund has not restricted itself from taking credit calls (readers should know that ICICI sailed through the credit crises without any defaults in their portfolio and manages the risk really well by diversifying the holdings across different issuers and groups). The fund has a mandate to invest at least 65% as gross equity exposure but can take the unhedged equity levels tin the range of 30% to 80% (by using derivatives to bring the net equity levels below 65%).

I would just like to highlight fund has seven fund managers, three for equity which includes Sankaran Naren, two for debt, one for derivative transactions and one for overseas investment.There is a provision to buy Foreign securities and that’s why AMC have nameda fund manager for this purpose …. but AMC may not necessarily buy foreign securities actively.

To all the critics who have a reservation that managing this size of AUM will have impact cost, I would just like to state, for buy low sell high, counter cyclical strategies, size of the fund won’t have any negative impact as the fund is buying when everyone is selling and is selling when everyone else is buying.

Unhedged Equity of ICICI BAF- FPA

Nippon India Balanced Advantage Fund:

Nippon India BAF is being managed by Manish Gunwani (he was the one who started this BAF model of ICICI, I have heard this and it may be wrong). The fund was launched in May’2018. They also follow counter cyclical approach and their in-house model takes into consideration estimated forward P/E and combination of short term and long-term trends. AMC is against the use of trailing P/E as it can give wrong impression about the valuations at the turn of the cycle. Forward p/E which is based on forward EPS is more reliable. (here the problem is in estimation of forward EPS, sometime, analysts get it right and sometimes get it wrong). Their unhedged equity range is in 30% to 85% and their investment universe for equity is either large cap or larger mid-caps. Debt Portfolio will be at shorter end of the yield curve and mostly in highest rates securities.

Edelweiss Balanced Advantage Fund:

Edelweiss BAF is the talk of the town.To the best of my knowledge it is the only BAF with pro-cyclical model and their in-house model is based on proprietary Edelweiss Equity Health Index. This model is based on buy high and sell higher theme. It aims to participate in bull market by higher equity exposure and tries to cut down on equities in bear phase.

It considers the short-term market trend and moving averages of Nifty to indicate the bull or bear trend. On the basis of market volatility and downside deviation of Nifty the sustainability of current trend is decided. These factors become the core of the model. The overriding factors to gauge the strength of overall economy and its strength are based on fundamentals like market valuation and macro-economic factors.

The equity mandate is to have 30% to 80% unhedged exposure. Stock selection is market cap agnostic and is based on management quality, high free cash flows, strong sector and earnings growth, competitive advantage and attractive valuation which provides margin of safety. The debt exposure has defined duration between 1 to 3 years with an objective to generate accrual income while holding government securities and AAA rated Corporate Bonds.

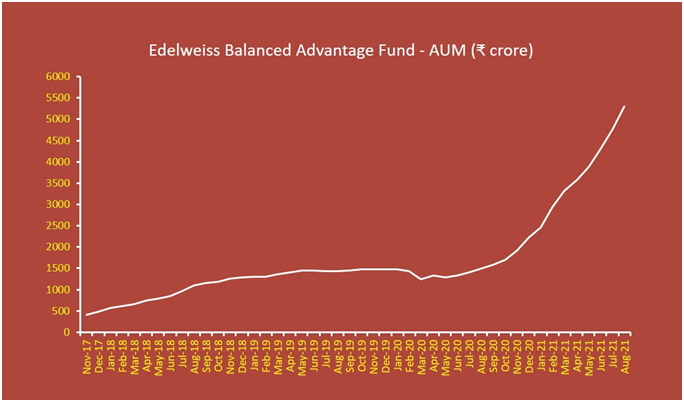

If any representative from Edelweiss MF is reading this I would like to congratulate them, their model of making swift changes in equity levels during bear markets have worked tremendously well. In healthy market the scheme has captured a significant portion of the upside. Investors have rewarded the AMC and Fund management team with higher market share in this category. Below is the chart to showcase AUM growth for Edelweiss BAF since November’2017.

Edelweiss Balanced Advantage Fund

DSP Dynamic Asset Allocation Fund:

DSP Dynamic Asset Allocation Fund is also based on counter-cyclical model of buy low and sell high. Fund can have unhedged equity in the range of 20% to 90%.

Like other AMCs, this fund is also based on in house model which is a combination of Fundamental Factors as well as Technical Signals. AMC uses both, P/E and P/B as a fundamental factor to determine core equity allocation. Technical Signal are used to capture the market uptrends by adding extra 10% to the core equity allocation. AMC uses 50 DMA and 200 DMA as technical signals. To save on transaction costs, the in-house model calculates the final equity allocation by taking 30 DMA of Daily equity allocation.

The equity stock selection is based on management, business and growth with 75% to 80% of equity allocation in structural themes and 20% to 25% in tactical ideas. Fund is cap agnostic and portfolio is diversified but with large cap bias. No stock has significant weightage for the sole reason of controlling the volatility.

HDFC Balanced Advantage Fund:

It’s an interesting story, HDFC was running a fund named HDFC Growth Fund. After the SEBI recategorization, this fund was converted into Balanced Advantage Fund. Another Fund, HDFC Prudence Fund was merged with HDFC Balanced Advantage Fund.

HDFC Prudence Fund was aggressive version of a balanced fund. It was started in 1994. Whatever past performance we see of HDFC Balanced Advantage Fund is that of HDFC Prudence Fund and it is in line with SEBI circular on Performance disclosure post consolidation/ merger of scheme dated April 12, 2018.

Here point I am trying to make is; the performance which investors or prospective investors are trying to assess is of a fund which had a mandate like that of equity hybrid fund.

I was also not able to figure out what kind of strategy this fund is following. Only thing which I was able to figure out is that, the fund has reduced equity exposure with rising market, so maybe it is following counter cyclical approach.

Regarding the unhedged equity, only thing, I was able to figure out is that the fund will not go beyond 90%

The presentation of the fund, looked more like a presentation on equity and debt outlook with notes on sector valuations, projected EPS growth,

Today, this fund has the highest AUM in the category of ~ 42,000 Crore

Unhedged Equity HDFC BAF – FPA

I have no idea, how this fund is dynamically managing anything. Inspite of so much volatility, the equity exposure in the period from October’2018 till December’2020 ranged from 79% to 84%. Andthe bigger problem is, that fund has now reduced the equity exposure to below 70%.s

I have no idea; what model AMC is following or is it totally discretionary or just random. If you like the equity strategy of the fund house, you should move to any other scheme in the same fund house. And if you are really interested in BAF/DAAF as a category, this is not the fund to be in.

Kotak Balanced Advantage Fund:

One more BAF following counter-cyclical model based on two factor model. Primary Factor to determine equity allocation is based on Trailing P/E of Nifty 50, other factors include fundamental attributes like P/B, Market cap to GDP and sentiment gauge (where AMCconsidersmultiple parameters like long-range rolling returns, volatility, breath of markets etc).

The fund has demonstrated agility and discipline in reducing equity on multiple occasions (like September’2018, July’2019, March’2020 and Feburary’2021) and have added significantly whenever the market presented opportunity. For example, the fund invested aggressively in the month of March (unhedged equity = 76.50%, mandate 20% to 80%) and was able to capture the board move in April’2020. Currently, at the end of August the fund has around 35.54% unhedged equity exposure.

Unhedged Equity Kotak BAF – FPA

The fund is cap agnostic and run a conservative mandate by allocating 75% of the directional equity in large cap and remaining in mid and small cap. Debt portfolio is majorly constructed through sovereign securities and at this point fund has relatively high interest rate sensitivity compared to peers.

As the fund is relatively new, launched in August’2018 and has done well in managing the volatility as compared to its peers. But I will say, we should still give two more years before taking any call on this fund. As it is a model driven fund, I will wait till the time five-year data is not available.

Balanced Advantage Fund – FPA

Nothing in this article should be constructed as investment advice; readers are advised to consult their advisors before making any investment decisions.

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Courses