Nishant Batra – Research Head

“RBI asks to fully write down Rs 318.20 crore of Laxmi Villas Bank’s Tier-II bonds”

“Yes Bank AT1 bond write-down: RBI says investors can’t blame regulator after enjoying high returns in good times”

Headlines like these started doing the rounds after the respective incident for write down of AT2 perpetual bonds of Lakshmi Villas Bank and AT1 perpetual bonds of Yes Bank & investors have a lot of questions and confusions regarding the same. In this article, I will try to explain about perpetual bonds and why retail should stay away from these quasi-equity instruments.AVOID PERPETUAL BONDS (I have used Bold, Italic and Underline to highlight, can’t shout on a word document, this image might help).

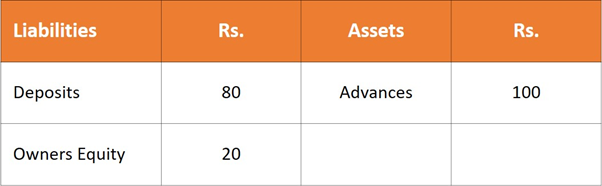

One-line explanation for bank’s business model can be they take deposit from the savers and lend them to borrowers at slightly higher rate.

Now think of a situation, where the 10% of the borrowers have defaulted, how will the bank pay the all the savers (depositors).

IN this case, either all the depositors have to take the hit of 10% each or 10% of the depositors (by value) will not get anything. In this example, Bank was trying to earn Interest Margin without investing anything. Total risk was borne by the depositors. Regulators will not like this situation.

Now consider the above situation again with slight adjustment.

Bank’s owners put in 20 as capital and now again assume 10% of depositors defaulted. In this case, depositors will not be penalised, they will not have to take any haircut. Owner will take the loss. This is where the concept of Regulatory Capital comes in.

There are different hierarchies of money which bank use for lending, riskiest category among them is equity capital — money put in by the promoters and other shareholders. It is the riskiest category of capital and in returns they get to share the profits/dividends of the bank. Last in the line is the depositor’s money which only get pre-determined interest with no secondary market. And in between equity capital and depositor’s money is AT1 and AT2 bonds. Please note AT1 bonds are riskier than AT2 bonds.

Learn how to pick the right Equity & Debt Mutual fund through our online training module

Capital to Risk-weighted Assets Ratio (CRAR)

The Capital to Risk (Weighted) Assets Ratio (CRAR), is also referred to as the Capital Adequacy Ratio (CAR). It is the ratio of the bank’s capital assets to the risk weighted assets.

CRAR is decided by the bank regulators to prevent banks from taking excess leverage and becoming insolvent in the process.

The Central Bank considers the relevant risk factors and the internal capital adequacy assessments of each bank to ensure that the capital held by a bank is in proportion with the bank’s overall risk profile.

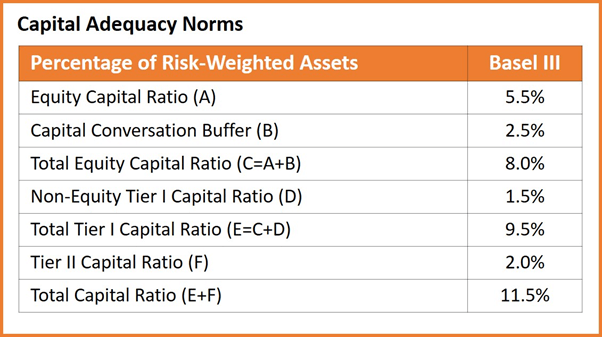

Banks are expected to maintain a minimum 11.5% capital adequacy ratio (CAR)

It will consist of the sum of the following categories:

1. Tier 1 Capital (9.5%)

a. Common Equity Tier 1 (8%)

b. Additional Tier 1 (1.5%)

2. Tier 2 Capital (2%)

From regulatory capital view point, going-concern capital is the capital which can soak up losses without setting-off bankruptcy of the bank, this is the Tier I Capital.

Gone-concern capital is the capital which can absorb losses only in a situation of liquidation of the bank. This is Tier II Capital.

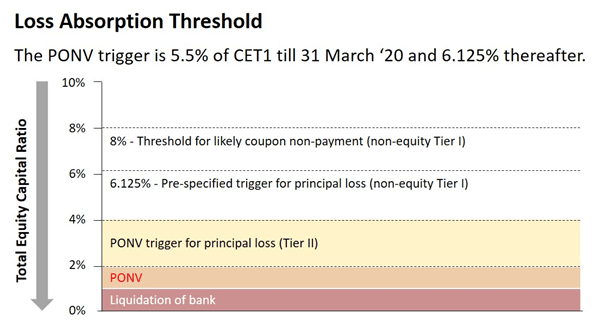

Point of Non-Viability (PONV)

As per the RBI guidelines a Non-Viable Bank is:

- A bank which, owing to its financial and other difficulties, may no longer remain a going concern on its own in the opinion of the Reserve Bank unless suitable course of action are taken to revive its operations and thus, empower it to continue as a going concern.

- The difficulties faced by a bank should be such that these are likely to result in financial losses and raising the Common Equity Tier 1 capital of the bank should be considered as the most pertinent way to prevent the bank from turning non-viable. Such measures would include write-off/conversion (partly or fully) of non-equity regulatory capital into common shares along with other measures, if required, as considered suitable by the Reserve Bank

Once the principal of the Bonds has been written down pursuant to PONV trigger Event, the PONV Write Down Amount will not be restored in any circumstances, including where the PONV Trigger Event has ceased to continue.

CET1 (Common Equity Tier 1) Trigger Event

It means the Bank’s CET 1 Ratio is:

- if calculated at any time prior to March 31, 2019, at or below 5.5%; or

- if calculated at any time from and including March 31, 2019, at or below 6.125%, (the “CET1 Trigger Event Threshold”)

The different classes of assets carry different risk weights, for example government bonds are considered low-risk and assigned a 0% risk weighting. This risk weight classification ensures, the bank who takes more risk (unsecured lending, credit cards, venture capital debt, large corporate loans) have to bring in more capital versus the bank which take less risk (home loans, gold loans, small ticket loans, loans against collateral).

In simple language as the bank’s advances go bad, its capital ratios come down. Let’s see in brief, what happens at what levels of capital in below image.

The write-off of any common equity tier1 capital shall not be required before the write-off of any non-equity (Additional Tier 1and Tier 2) regulatory capital instrument. (this is the clause why, Yes Bank common equity was not written down whereas Tier I bonds were written down. Even Tier II bonds were not written down).

Now let’s come to the main topic of this blog, why retail investors should avoid perpetual bond, both tier I and tier II:

1. Coupon at the Discretion of Issuer

The Bank may choose, at its full discretion, to cancel (in whole or in part) Coupon scheduled to be paid in order to comply under Basel III Regulations (. Coupon on the Bonds are non-cumulative i.e. if coupon is

cancelled or paid at a rate lesser than the Coupon Rate, the unpaid coupon will not be paid in future years. Non-payment of coupon will not constitute an Event of Default in respect of the Bonds.

2. Call Option and perpetuity

Generally, the issuer bank has the call option to call the bonds after the 05th/10th anniversary from the date of allotment. Let us assume a hypothetical condition, a perpetual bond was issued at 7% Coupon at par. Near to the date of issuer call option, the interest rate in economy have gone up and now freshly issued bonds are fetching 11% Coupon. Why will the issuer call the bond back at par and raise fresh capital at 11%. The issuer will never call the bond back until the interest rate in economy comes down near to 7% or lower. (theoretically speaking).

3. Fixed Income like upside and penny stock like downside

These perpetual bonds or for this argument, any risky fixed income instrument, has upside of a fixed income for a held till maturity investor i.e. the best case possible is one will keep getting the coupon on time and face value on maturity but on the flip side you will not loose extra percent but you can lose the entire principal along with accrued interest.

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB)

Not comparable to Fixed Deposit:

Let’s get it straight, these bonds are not at all comparable to Fixed Deposit. A number of features distinguish fixed deposits with these perpetual bonds.

- Up to INR 5 Lakh per PAN per Bank, your deposits are insured but perpetual bonds are not.

- Fixed Deposits have liquidity at issuer level, you can anytime (24X7 digitally) go to your bank and liquidate your fixed deposit, only implication will be premature penalty. Premature penalty is only about interest rate to be applied on principal, principal is not affected in premature liquidation. These bond on the other hand have liquidity only in secondary market (except for call dates) and due to interest rate cycle, credit rating of the issuer can go down in value and can even go down to zero as Yes Bank Tier I bond and Lakshmi Villas Bank Tier II Bond (Please note Lakshmi Villas Bank had no outstanding Tier I Bonds).

- Fixed Deposits in a scheduled commercial bank have never gone bad, there had been instances like Global Trust Bank, Yes Bank and now Lakshmi Villas Bank, but RBI has intervened on each occasion and depositors have not taken any hit.

- There is certainty of interest income in Fixed Deposit whereas issuer Bank has the discretion whether to make coupon payment or not, partially or fully.

- Fixed Deposits have a fixed maturity date on the other hand perpetual bonds have a call date which is at the discretion of the issuer. Theoretically, the issuer may never call back the bond and keep paying the coupon (in case the interest rate goes up significantly).

Some random thoughts:

- This event where RBI has taken unprecedented stance to write off the AT2 bonds of Lakshmi Villas Bank will lead to more refine approach in evaluating the risk profile of deposits and tier II bonds.

- After the Yes Bank and Lakshmi Villas Bank fiasco, the cost of borrowing of weak and small private sector bank through this route will rise as investors will not ignore the loss absorption feature of these instruments.

- Interest Rate have come down globally, that’s the realty and one should accept it, instead investors try and find opportunities with higher yield. Higher yield comes with higher risk. Try to find something with reasonable yield with the backing of the government. Don’t try to be fancy, losing the entire capital for few additional bps can spoil the financial plan and bring in a lot of mental trauma.

- SEBI has also taken some steps to ensure AT 1 Perpetual Bond stay away from the reach of retail investors. Considering the unique features of AT 1 perpetual bonds which grant the issuer banks (in consultation with RBI) discretion to write down the principal (fully or partially), to skip interest payments, to make early recall (only due to tax or regulatory issues) etc. without giving comparable right for investors to legal recourse, SEBI made it mandatory, effective 12th October’2020, that issuance of AT1 bonds is restricted to Qualified Institutional Buyers. SEBI also raised the minimum allotment size to INR 1 crore to make these tricky bonds out of the reach of retail investors even from the secondary market. Trading lot size was also increased to INR 1 Crore.

- These perpetual bonds can really become perpetual. Although issuer banks have the option to not exercise the call features of these bonds, so far, all banks have exercised the call option on the first call date and have paid back the face value to the investors. But one particular instance needs to be highlighted, Andhra Bank, in December’2019 decided not to call back the perpetual bonds. But on the very next day, the bank flipped its stance and decided otherwise. Bank changed the decision on concerns that this behaviour would disrupt the market for AT1 bonds for other public sector banks as well. Day is not far when this false assumption of investors that Perpetual Bonds will anyway be called back on first maturity day sees an exception. These bonds should never be used for goal planning based on call option of the isser.

- While selecting a debt mutual fund scheme, scheme with high exposure to perpetual bonds should be discarded. Same should be checked in debt portfolio of hybrid schemes.

- Once the bad news start hitting the market for a particular issuer bank, yields of perpetual bonds go up for that issuer thus impacting the market value of the bond.

Learn how to pick the right Equity & Debt Mutual fund through our online training module

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Courses

Nothing in this article should be constructed as investment advice; readers are advised to consult their advisors before making any investment decisions.