ABOUT BIA

A Bachelor’s in International Accounting (BIA) program focuses on preparing students for accounting roles in a global environment. The curriculum goes beyond standard practice, heavily emphasizing International Financial Reporting Standards (IFRS), cross-border tax issues and the ethical and legal frameworks of worldwide commerce. This specialization equips graduates with the financial analysis and auditing skills necessary to manage the finances of multinational corporations (MNCs) and succeed in international firms and regulatory bodies.

ABOUT ACCA (Association of Chartered Certified Accountants)

ACCA is a prominent global professional accountancy body:

- Founded in 1904, ACCA is one of the world’s oldest and yet most forward-thinking professional accountancy bodies.

- ACCA has more than 219,000 fully qualified members and 527,000 future members worldwide.

- They are among the world’s best qualified and most highly sought-after accountants, working in every sector.

- With students in over 180 countries and offices in 50 plus countries, ACCA is a truly global CA qualification.

- ACCA is a most sought-after qualification in the UK, Europe, Middle East, South East and Australia and has become a huge ‘in demand’ program in India.

- Huge opportunities exist for ACCA’s at Big4’s like EY, Deloitte, KPMG, PWC; Top Banks like Morgan Stanley, State Street, UBS, as well as MNCs like TCS, Maersk and Accenture.

Why BIA

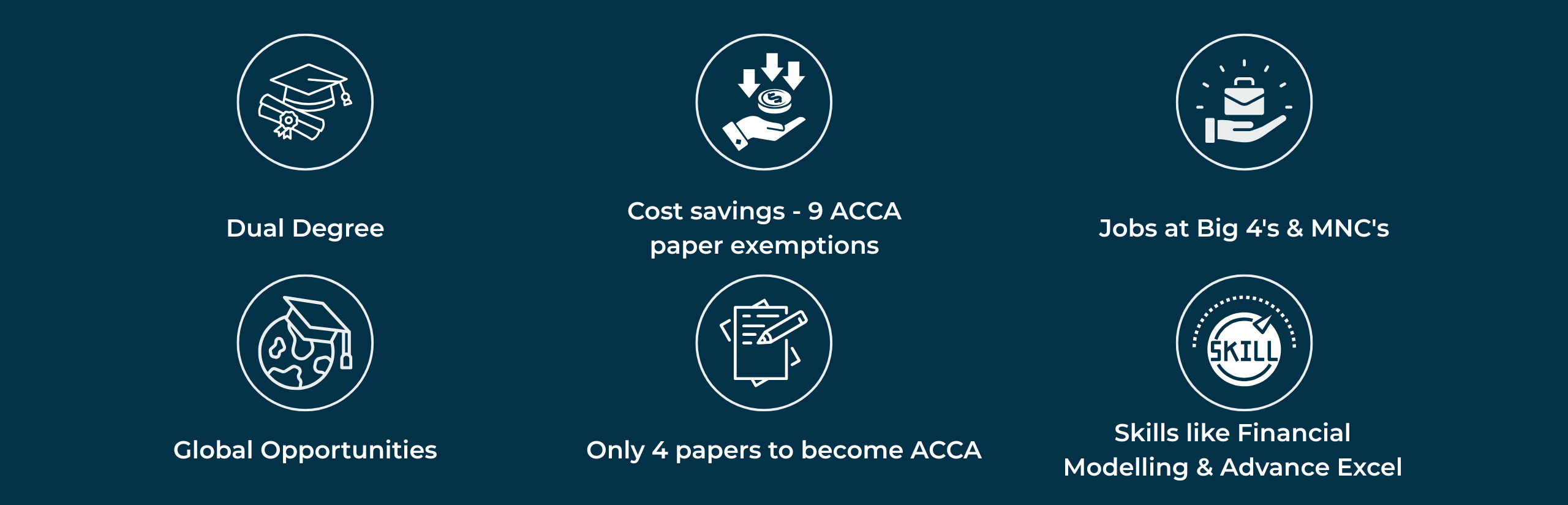

Dual Degree

Dual Degree

Cost savings - 9 ACCA Paper exemptions

Cost savings - 9 ACCA Paper exemptions

Jobs at Big 4’s & MNCs

Jobs at Big 4’s & MNCs

Global opportunities

Global opportunities

Only 4 papers to become ACCA

Only 4 papers to become ACCA

Skills like financial Modelling & Advance Excel

Skills like financial Modelling & Advance Excel

BIA Curriculum (Bachelor’s in International Accounting)

Semester I

- Global Financial Accounting (KL)

- Strategic Cost & Management Accounting (KL)

- Quantitative Techniques for Business & Finance

- International Business Law & Commercial Transactions (KL)

- Microeconomic Theory & Decision-Making

- Advance Excel for Accounting & Finance

- Professional Communication

- Understanding India

- IKS

- Co-curricular

Semester II

- Global Financial Accounting – II (KL)

- Cost & Management Analytics (KL)

- Business Metrics & Statistical Insights

- Corporate Law & Governance (KL)

- Global Economics & Financial Systems

- Essentials of Modern Marketing

- Collaborative Communication & Team Dynamics

- ESG & Sustainable Business Practices

- Co-curricular

Semester III

- International Financial Reporting (SL)

- Strategic Financial Management & Decision Making (SL)

- Business Dynamics & Technological Impact (KL)

- Audit & Governance (SL)

- Digital Marketing

- English – I

- CC

- FP

Semester IV

- Advance Financial Reporting & Consolidation (SL)

- Financial Management, Valuations & Capital Decisions (SL)

- Business Leadership & Performance (KL)

- Audit Assurance & Risk Management (SL)

- Personal Finance & Wealth Management

- English – II

- CC

- FP

Semester V

- Corporate Financial Reporting & Ethics (PL)

- Corporate Financial Reporting & Analysis (PL)

- Financial Analytics

- International Taxation & Compliance (SL)

- Performance Management (SL)

- Stakeholders Management

- FP

Semester VI

- Strategic Business Leadership (PL)

- Strategic Risk Management & Corporate Governance (PL)

- Financial Modelling

- Corporate & International Taxation (SL)

- Efficiency & Cost Management Techniques (SL)

- CC

- FP

BIA Student Journey with ACCA

- Students enrollment completed – ACCA registration and Conditional Exemptions applied.

- Over 6 semesters students study and give exams for regular courses + ACCA’s 9 papers that will be exempted.

- On the way, pick up additional skills like Advance Excel, Financial Modeling & Wealth Management.

- In Sem 5 and Sem 6 study for 2 non-exempted papers, sit the ACCA exams after college exams.

- Post Sem 6 attend lectures for remaining 2 non-exempted papers at IPA and clear them in following quarters.

ACCA Curriculum

The ACCA curriculum is divided into Four levels:

1. Knowledge Level

- Business & Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

2. Skill Level

- Corporate & Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit & Assurance (AA)

- Financial Management (FM)

3. Professional Level (Essentials)

- Strategic Business Reporting (SBR)

- Strategic Business Leader (SBL)

4. Professional Level (Optional Papers)

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit & Assurance (AAA)

Optional Certification & Degree Routes

- Diploma in Accounting & Business

- Advance Diploma in Accounting & Business

- BSc in Applied Accounting Awarded by Oxford Brookes University

- Professional Level Certificate & ACCA Affiliate Status

- ACCA Membership

- MSc in Professional Accountancy Awarded by University of London

BIA Course HIGHLIGHTS

- Dual qualification within 3 years.

- Graduation degree from Mumbai University along with professional qualification of ACCA.

- In college training for both graduation and ACCA.

- Lower cost compared to taking professional course from separate institutes.

- Saves time by allowing students to complete both qualifications than it would take to pursue them separately.

- Training from highly qualified faculties and Industry experts.

- Access to world class LMS with recorded lectures and unlimited mocks.

- Individual attention to each student and one on one mentorship.

- 100% placement assistance after the completion of the course.

- Extra-curricular activities like MUN, Book Reviews, Industrial Visits for ensure overall development of the student.

- Comprehensive training of resume building, mock interviews and Interpersonal skills.

- Platinum Approved Partner delivering trusted expertise, premium solutions and proven results.

Our Placements