About BFM – CFP®

The BFM – CFP® programme at K. P. B. Hinduja College of Commerce (Autonomous) seamlessly integrates the academic rigor of the Bachelor of Financial Markets with the global credibility of the Certified Financial Planner (CFP®) certification. The BFM curriculum offers strong theoretical and practical grounding in financial markets, investments, economics, derivatives, risk management and regulatory frameworks. Complementing this foundation, the CFP® component focuses on comprehensive financial planning, including wealth management, investment strategy, tax planning, retirement and estate planning and professional ethics. The CFP® certification is governed and awarded in India by the Financial Planning Standards Board India (FPSBI India), the authorized body that upholds global standards of professional competence and ethical practice. This integrated programme enables students to develop advanced financial expertise while progressing toward an internationally recognized professional qualification alongside their undergraduate studies.

About CFP® Certification

- CFP® stands for Certified Financial Planner, a globally respected professional certification in the field of financial planning and wealth management.

- It is awarded by the Financial Planning Standards Board India (FPSBI) and its authorized affiliates, the global standards-setting body for financial planning.

- The CFP® community spans 2,00,000+ professionals worldwide, with the certification recognized in 27+ countries, making it an internationally valued credential.

- CFP® is regarded as the gold standard in personal financial planning, with a strong emphasis on holistic, client-centric financial advice

- Designed for professionals who aspire to move beyond product selling and become trusted financial advisors and wealth managers.

- Highly relevant for careers in wealth management firms, banks, insurance companies, investment advisory firms and family offices, the program builds strong expertise in the stock market, mutual funds, financial markets, fundamental analysis, portfolio management and company valuation.

- The curriculum is practical, case-based and application-oriented, focusing on real-life financial planning scenarios rather than heavy theory.

- Ideal for students targeting leadership and advisory roles such as Financial Planner, Wealth Manager, Investment Advisor, Relationship Manager, Private Banking Professional, Research Analyst and Tax Consultant.

About K.P.B. Hinduja College of Commerce (Autonomous)

K.P.B. Hinduja College of Commerce (Autonomous), founded in 1974, is a leading Mumbai institution recognized for academic excellence, industry-focused education and strong social values, with NAAC A+ accreditation and UGC excellence status.

K. P. B. Hinduja College of Commerce (Autonomous) has collaborated with an FPA Edutech – A Platinum learning approved provider for CFP® education provider to offer the Certified Financial Planner (CFP®) programme. Students enrolling for this course will be eligible for special academic pricing and applicable discounts on CFP® certification and examination fees, as per FPSBI norms.

Location of the College: 315, New Charni Road, Charni Road East, Opera House, Girgaon, Mumbai, Maharashtra 400004

Why BFM – CFP®

Dual Qualification within 3 years

Dual Qualification within 3 years

Opens pathways to entrepreneurial opportunities, enabling students to start their own financial advisory, investment consulting or wealth management practice.

Opens pathways to entrepreneurial opportunities, enabling students to start their own financial advisory, investment consulting or wealth management practice.

Along with the BFM-CFP® curriculum, students will also be prepared for NISM certifications, strengthening their regulatory knowledge and industry credibility for careers in finance and investments.

Along with the BFM-CFP® curriculum, students will also be prepared for NISM certifications, strengthening their regulatory knowledge and industry credibility for careers in finance and investments.

In-college training for both the BFM degree and CFP® curriculum

In-college training for both the BFM degree and CFP® curriculum

Lower cost and significant time savings compared to pursuing graduation and professional certification separately

Lower cost and significant time savings compared to pursuing graduation and professional certification separately

Training by experienced faculty members and industry practitioners from the financial services and wealth management sectors

Training by experienced faculty members and industry practitioners from the financial services and wealth management sectors

100% Placement Assistance with personalized mentoring and career guidance

100% Placement Assistance with personalized mentoring and career guidance

Application-oriented learning with strong focus on practical financial planning, client advisory and industry-ready skills

Application-oriented learning with strong focus on practical financial planning, client advisory and industry-ready skills

Strong career prospects in portfolio management companies, AMCs, wealth management, banking, investment advisory and financial services firms, with attractive starting salaries and long-term global career opportunities

Strong career prospects in portfolio management companies, AMCs, wealth management, banking, investment advisory and financial services firms, with attractive starting salaries and long-term global career opportunities

The CFP® certification is regulated and awarded in India by the Financial Planning Standards Board India (FPSBI India), ensuring that the qualification meets globally recognized standards of professionalism, ethics, and competence in financial planning.

The CFP® certification is regulated and awarded in India by the Financial Planning Standards Board India (FPSBI India), ensuring that the qualification meets globally recognized standards of professionalism, ethics, and competence in financial planning.

BFM – CFP® CURRICULUM

The curriculum is structured across six semesters.

Semester I

- Personal Financial Management – I

- Investment Planning – I

- Business Mathematics

- Business Economics – I

- Cost Accounting – I

- Management Accounting – I

- Professional Communication

- Foundation Course

- Indian Ethos in Ethical Investment

- Co-Curricular Courses (CC)

Semester II

- Personal Financial Management – II

- Investment Planning – II

- Introduction to Financial Statements

- Business Statistics

- Business Economics – II

- Cost Accounting – II

- Management Accounting – II

- Group Communication

- Sustainability Management (ESG)

- Co-Curricular Courses (CC)

Semester III

- Financial Valuation

- Investment Planning – III

- Financial Statement Analysis

- Digital Marketing

- Tax Planning – I

- Hindi – I / English Literature

- Co-Curricular Courses (CC)

Semester IV

- Risk Planning

- Estate Planning

- Financial Modelling

- Computer Skills

- Tax Planning – II

- Hindi – II / English Literature

- Co-Curricular Courses (CC)

- Community Engagement Program

Semester V

- Tax Planning – III

- Retirement Planning

Semester VI

- Financial Planning Components

- Financial Plan Construction

BFM Student Journey with CFP®

- Over six semesters, students pursue the BFM curriculum alongside integrated preparation for the CFP® programme, covering all core modules of financial planning.

- Throughout the three years, students develop industry-relevant skills such as Investment Analysis, Portfolio Construction, Wealth Management Practices, Financial Planning Software usage, Client Advisory Skills, Advanced Excel and professional soft skills.

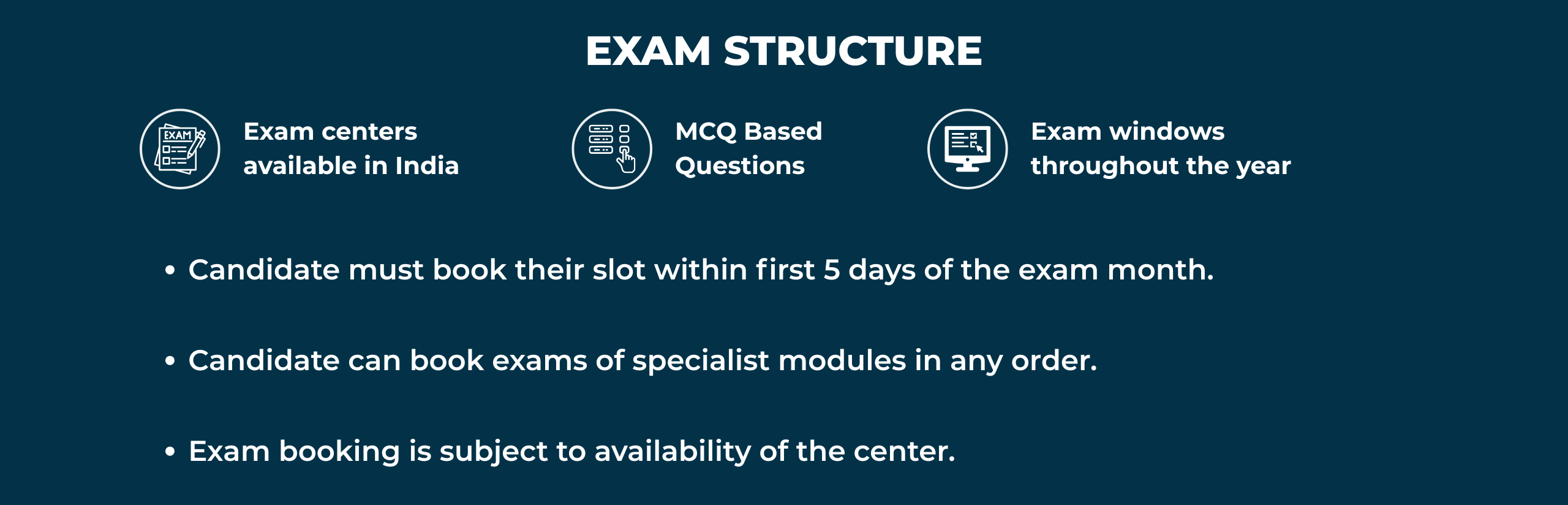

- During the programme, students appear for CFP® examinations module-wise, in alignment with the academic progression and FPSBI guidelines.

- Post Semester Six, students continue to receive academic mentoring, examination support, certification completion guidance and placement assistance to successfully complete the CFP® certification and transition into professional roles in the financial services industry.

CFP® Course Eligibility

XIIth pass (in any stream) and Working Professionals from any sector can pursue CFP® Certification. Membership Eligibility for CFP® Certification:

CFP® CERTIFICATION ELIGIBILITY

- Undergraduate Degree

- Pass all modules of CFP® Certification

- 1 or 3 years relevant experience

Our Placements