About The CFP® Certification in Mumbai

Once you have completed CFP® Certification in India, you can practice as a CFP® in 27 countries across the globe.(Respective country’s board requirement needs to be fulfilled)

A CFP® is recognized as a leader in the field of Financial Planning across the globe.

Allows you to join an elite group of CFP® Professionals in 27 countries across the globe.

CFP® coaching plays a vital role in preparing aspiring candidates for the rigorous CFP® classes in Mumbai, ensuring they acquire the necessary knowledge and skills to excel in the field of Finance.

Why To Choose FPA

Premium Education Provider for CFP® Certification

Passing Rate more than the Industry

Comprehensive CFP® Certification Materials

CFP® Qualified Faculty

Alumni Network Over 11K+ Students

Live Classroom Sessions

In-house Learning Management Platform

100% Placement Assistances

CFP® Course Eligibility

Regular Mode :

- Anybody who has cleared 12th grade or equivalent in any stream

- Graduate & Under Graduates: B.Com, BFM, BAF, BBI, BIM, BMS, BBA etc

- Postgraduates & Professionals: Education – CA – Inter, CA, MBA, M.Com etc

Qualification – Insurance, Mutual Fund Advisors, Stockbroker, wealth manager, relationship manager with relevant qualification is eligible to give only the one examination under challenge status mode

Challenge Status :

- A Post Graduate in Finance with 3 years of relevant experience can opt for giving only 1 exam i.e. Integrated Financial Planning, for acquiring the CFP® certification

CFP® Syllabus

Investment Planning Specialist Module

- Personal Financial Management

- Investment Planning & Asset Management

- Regulatory Environment, Law & Compliance

Retirement and Tax Planning Specialist Module:

- Retirement Planning

- Tax Planning

Risk and Estate Planning Specialist Module

- Risk Planning

- Estate Planning

Financial Plan Construction & Integrated

- Financial Planning Module

- Financial Planning Process & Skills

- Engaging Clients in Financial Planning

- Integrated Financial Planning

- Case Study & Capstone Project

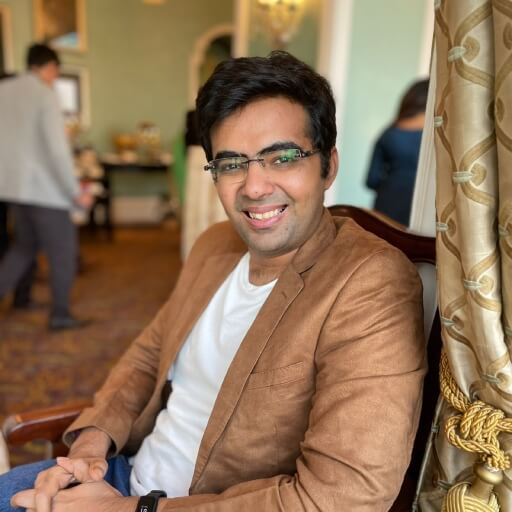

Our Mentors

Kirtan Shah CFP®

Jeetendra Peswani CFP® & CFA

Our Placements

Success Story

I have cleared my CFP®. Much thanks to FPA. Jeetendar Sir has regularly offered timely support and guidance, as well as other faculty members and support staff. Would like to mention Sagar Sir, Yukti Ma'am and Aman Sir for their time, effort and patience with all students.

I've been associated with FPA since the month of July 2020. I enrolled for CFP® certification. The quality of faculty over here especially Jeetu Sir and Yukti Ma'am is exceptionally great. They solve your doubts during and after the lectures. They help you in every way possible. Surely going to recommend FPA to anyone, who is looking for pursuing CFP® Certification.

I have cleared CFP® throughout with the help of FPA. The videos & material are detailed and helpful. And faculties are also very supportive, even distance learning can help students too. A day before the exam it helped me a lot. Big thanks to everyone, and FPA Rocks!!

I would like to thank the entire FPA team for helping me clear the CFP® examination within the stipulated time frame. The video lectures of Yukti ma'am and the doubt-solving assistance of Mansi ma'am and Pooja ma'am were really helpful. I would recommend anyone pursuing CFP® Certification only choose FPA.

I am happy to share that I have cleared CFP® - Final Module with a Good Grade on the first attempt. I am very grateful to Janak Sir, Sagar Sir, Yukti Ma'am and all doubt-solving faculties for teaching and guiding me in completing my CFP®. I would recommend FPA to everyone.

As I decided to pursue the CFP course, I was on the lookout for the right institute . A relative suggested FPA. During both the modules, the FPA Team supported me in every way. Be it doubt solving, queries to admin, the faculty. On clearing 2 modules, the FPA Placement Team promptly sent me a job description, forwarded my resume and connected me with the firm. I Got a call, cracked the interview the next day and here I am, kickstarting my financial journey at Sujith Shah Financial Services as a Paraplanner- trainee. Thanks to the FPA, mentors and the Placement team for being so supportive and pro-active in their role.

The only true wisdom is in knowing you know nothing. This has been my Philosophy since the Start of my Financial Planning career, which has led me here. From a Rookie to a Professional Financial Planner, the journey was no less than a Roller Coaster ride. But the best part is, I enjoyed every moment of it. Thank you Kirtan Shah Sir.

Glad to share that I have cleared two modules of Certified Financial Planner (CFP) exam - Investment Planning Specialist & Risk and Estate Planning. A CFP® is recognized as a leader in the field of Financial Planning across the globe. It would not have been possible without the guidance and expertise of FPA Edutech. Highly Recommend

I would like to thank FPA Edutech for their constant guidance and support. Blessed to have mentors like Yukti Gala, Sagar Chedda and others at FPA who made learning fun and enjoyable. Because of the amazing faculty members I completed all my Specialist modules within just 10 months. With your support will surely earn the CFP badge soon.

Thrilled to share that I’ve successfully passed the REPS module of the CFP certification. A big thank you to the FPA my mentor Yukti Gala and staff for the support throughout the journey. The course provided deep insights into risk and estate planning, equipping me with the knowledge to help individuals secure their financial future.

FAQs

How to get started?

FPA is the most recognised authorised education provider for CFP® Course in Mumbai where you can get all the guidance needed for the CFP® certification pathway, Call us at +91 8080809466

In how many months can I clear the CFP® exams?

10-12 months

Can I practice or open my own financial planning boutique after completing CFP® Certification?

Yes, you can become an entrepreneur and practice as a Certified Financial Planner provided you have a valid CFP® certification.

Can CFP® qualification help me go abroad?

Yes, the CFP® Classes in Mumbai is recognized in 27 countries .

When are the classes for CFP® conducted at FPA?

We conduct CFP® coaching in Mumbai on weekends, i.e., Saturdays and Sundays

Is CFP® Course Recognized Globally?

Yes, the CFP® course is recognized in 27 countries & helps you make a global career.

We invite you to join of CFP® classes in Mumbai for the highest passing rate & full placement support