Gold

Gold is a highly liquid instrument/commodity acceptable all over the world. Throughout the history, Gold is the most popular metal for storage of wealth and as a source of high-quality and universally accepted collateral.

“The desire of gold is not for gold. It is for the means of freedom and benefit.”

Ralph Waldo Emerson

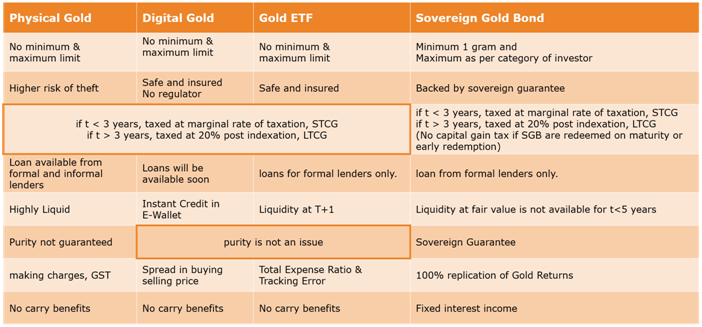

Are you planning to buy gold this festive season? Do you know allocation to gold can be taken by way of Sovereign Gold Bond, Gold ETFs and Physical Gold? Each has its own advantages and disadvantages and one should choose wisely.

Physical Gold being tangible in nature has emotional value over and above financial value.It can be bought from neighbourhood jeweller as well, very accessible. One can buy, coins, bars or ornaments. Apart from jewellers, coins and bars can be bought from Banks and institutions like MMTC.

Intangible Gold can be bought through pooled investment vehicles like Mutual Funds (from hereon we will discuss only ETFs and not Gold Funds), Digital Gold and Sovereign Gold Bonds.

In this article we will discuss in detail all these instruments, their return attributes, taxation, limitations, etc.

Physical Gold:

This is the form of gold people want to give/receive as gift. Human tendency is to gift something tangible. It can be bought from jewellers, whether neighbourhood or branded, although purity is a concern for non-hallmarked gold. The biggest advantage of buying gold in this form is (I hope Income Tax Authorities are not reading ??) the confidentiality. This form is universally acceptable not only in India but throughout the world, no one is interested in knowing the origin of purchase. As it is tangible, safety and storage areof concern and taxation is same of that a non-equity mutual fund i.e. for short term holding period of less than 3 years, gains (LTCG) are added to the income of the assessee and taxed at marginal rate of taxation and for holding period greater than 3 years, indexation benefit is available and tax rate is 20%. The biggest disadvantage of this form of gold is making charges, jewellers charge anything as high as up to 35% of the gold value as making charges. There is no limit on buying physical gold. There is a price difference in different geographies due to logistic charges.

Digital Gold:

Gold at your fingertips, this gold you can buy from your e-wallets like PayTM, Google Pay, Phone Pay, etc. and some other fintech platforms. The minimum amount of purchase can be as low as ? 1.00. The biggest plus here is purity and storage as compared to physical gold. Purity of gold varies from 995 (safegold) to 999.9 (MMTC-PAMP) but it is disclosed and the buyer is charged the price of disclosed purity. Digital Gold is backed by actual physical gold that is kept in bank grade secured vaults and is insured, even when the gold is in transit, it is insured. The big negative is the buy and sell price spread. This difference is due to a 3% GST and costs such as bank charges, payment costs, technology costs and hedging costs that these service providers borne. Taxation is same as that of physical gold. As per recent Income Tax regulations providing the PAN details is mandatory to undertake digital gold transactions. This is applicable starting 1st October, 2020.Market Value on selling the digital gold is instantly credited in e-wallet. One can also redeem the digital gold in physical form but has to pay the minting/ making charges, delivery chargesand applicable taxes. The custody shall be without charge for the first few years depending on the service provider, andthereafter, a fee will be levied to coverstorage costs.There is no regulator to monitor the checks of digital gold entities, however a third party trustee is appointed.

Gold ETFs:

All the leading AMCs have listed their Gold ETF some have also provided the solution in fund of fund structure. In more ways than one it scores over digital gold and physical gold, the first one being that smart investors have the option of buying/selling Gold ETFs at fair value (through creation of units from AMC directly, index funds vs ETFs) and even at discount/premium. One can invest as low as ? 50.00 (Nippon India Gold Bees is available at close to ? 45.00 rupees (closing price 12th November’2020)). There is no upper cap for investment amount.All the monies collected are deployed in 995 purity Gold which is stored with a custodian. Although GST is applicable for all the gold purchased by the fund but AMCs will adjust GST recoverable and take input tax credit of that. The purchase can be made in cash or in physical gold (in unit creation size subject to testing of gold quality). Similarly, while redeeming, physical delivery of Gold can be opted (minimum lot size and delivery will be at a centralised place, generally Mumbai). Taxation for investor is same as for physical gold and digital gold.

Sovereign Gold Bonds

Sovereign Gold Bonds are issued by the Reserve Bank of India on behalf of the Government of India and the borrowing through issuance of the Bonds form part of market borrowing programme of Government of India (Sovereign Gold Bonds are not backed by physical gold). One bond is equivalent to one gram of gold. However, in some of the earlier tranches ? 50 per gram flat discount has been given and for more recent tranches, issued price has been reduced by ? 50 per gram than the nominal value to those investors applying online and the payment against the application is made through digital mode.

Please note: in the first five tranches there was no discount, in next four tranches the discount was for both modes of subscription, online and offline AND from 10th tranche onwards the discount was limited to online subscriptions only.

It is the most beneficial instrument, if one has to take a long term call on gold. This instrument will give you interest at 2.5% (in initially issued tranches it was 2.75%) on the invested value, if subscribed through primary issue. And if subscribed through secondary market, interest calculation will be based on face value of the bond and not on the amount invested. For example, if you buy from exchange, one unit of an earlier issued tranche, let’s say SGBFEB28IX, it has a face value of ? 4070 but in secondary market available close to ? 4850, here interest yield for new buyer will fall to 2.10%.Interest income is taxable at marginal rate of taxation of assessee.

These instruments are available only for individuals, HUFs, Trusts, Universities & Charitable Institutions with the following quantity capping per financial year:

| Category | Minimum | Maximum |

|---|---|---|

| Individual | 1 gram* | 4 KG# |

| Hindu Undivided Family | 1 gram* | 4 KG# |

| Trusts, Universities & Charitable Institutions | 1 gram* | 20 KG# |

*in earlier tranches the minimum subscription limit was 2 grams and maximum was 500 gram for individuals and 10KG for trusts

#the annual ceiling per financial year is for units procured through bonds subscribed under different tranches during initial issuance and bought from exchange in a Financial Year.An investor can utilise the ceiling on fiscal year basis.

These Bonds have a tenor of 8 years but after 5 years, premature optional exits are available on interest payment dates. As the bonds are tradable on Exchanges, if held in demat form, can be sold on any trading day. It can also be transferred to any other eligible investor. NRIscannot buy Sovereign Gold Bonds. However, individual investors with subsequent change in residential status from resident to non-resident may continue to hold SGB till earlyredemption or maturity.

Capital Gains (short term as well as long term) arising from Sovereign Gold Bonds are exempted for individual investors (only individual investors)if bonds have been redeemed on maturity or early redemption (after 5 years) on interest payment dates. In case the SGBs are sold/transferred this benefit will not be available and tax treatment will be same as that of a physical Gold or Digital Gold or Gold ETF.

Observation of the writer

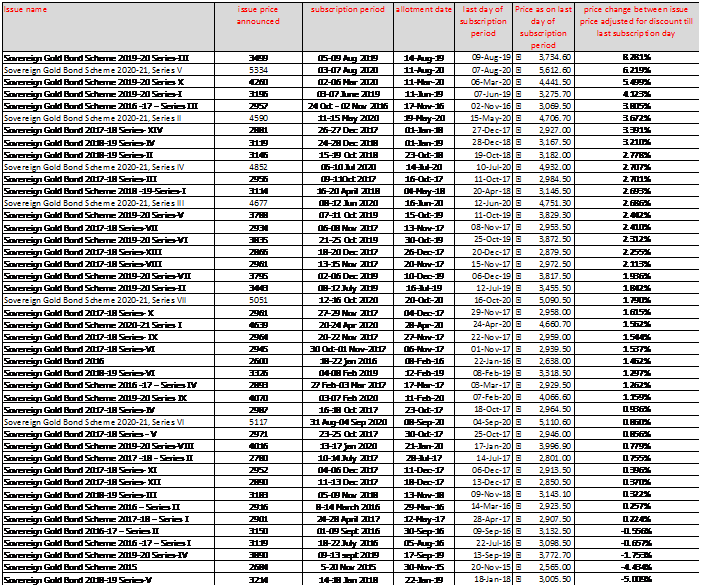

When the price of a fluctuating asset is fixed and subscription is open for few days, there is always scope for taking advantage of fluctuating prices. In the table below, there were opportunities when Gold was available up to 8.26% cheaper than the market. As a keen observer of anything and everything related to personal finance, just wanted to highlight this anomaly.

One of the Question which often get asked is about the default risk in case Gold Prices rises multiple folds.

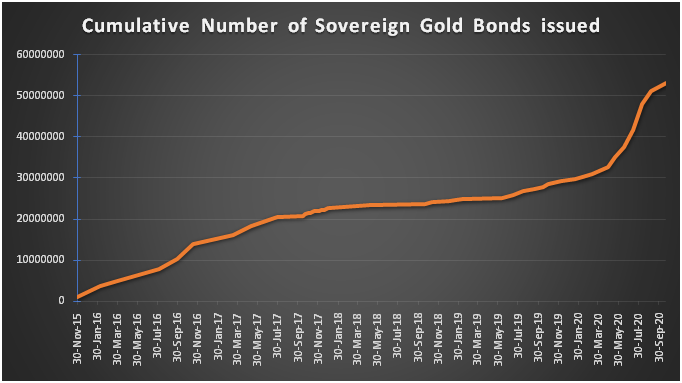

Let us first look at the total gold issued through Sovereign Gold Bonds. As on 20th October’2020, a total of 53213531 units have been issued which is roughly equal to 53 tonnes.

As per the half yearly report published by Reserve bank of India for the Report on Management of Foreign Exchange Reserves, as on 31st March’2020, the Reserve Bank held 653.01 tonnes of gold. Sovereign Gold Bonds issued till 20th October’2020 is approximately 53 tonnes.

Learn Personal Finance through Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB)

Summarize this Article with AI

Summarize this Article with AI