Fund of Fund – A Complicated Wrapper

Nishant Batra – Research Head

I could have named this article as A to Z about Fund of Funds but decided otherwise and went for “a complicated wrapper”. It will be short article as compared to the previous ones, but it will cover everything about Fund of Funds (FOF), A to Z about fund of funds ??

Let’s start with the very basic, what is Fund of Fund?

This category of Mutual Fund schemes invests the money in schemes of mutual funds and not directly in securities like shares, bonds, gold, etc.

There are primarily four kind of fund of funds

- Wrapper Around ETF

That just provide a wrapper on ETF, it can be gold ETF or an ETF replicating a benchmark like junior bees, Bharat Bond, bharat22, Nasdaq 100. In these types of FOF, AMC launches a FOF just to tap on to the investors who doesn’t have demat account and who want to enter into systematic transactions like SIP, STP and SWP as these features are not available in ETF. - Multi Manager within same asset class

Which provides multi manager mandate. Here the fund manager has the mandate to invest in different strategies, usually within the same asset class. Let’s take an example of ICICI Prudential India Equity FOF, this FOF is allocating mainly into equity strategies, some liquidity to meet redemptions.Axis All Seasons Debt Fund of Funds is another example, instead of equity it is allocating in fixed income strategies.Mirae Asset Equity Allocator Fund of Fund also qualifies in this category. - Multi Asset classes

Another set of Fund of Fund invests in different asset classes and some of them manages these asset classes dynamically, yes just like balanced advantage fund. Franklin India Dynamic Asset Allocation Fund of Fund manages the mandate dynamically whereas Franklin has different life stages FOF as well which follow different mandates. - Feeder Funds

A different genre of FOF invests in feeder funds, this could be due to geographical and currency diversification or lack of investment avenues on a particular avenue in India, for example, Edelweiss has a tie up with JP Morgan, DSP has a tie up with BlackRock, Axis has arrangements with Schroderbut global asset management companies operating in India like Franklin, HSBC or any other global asset manager, prefers to choose the underlying scheme of their parent company only. Examples of these funds can be, HSBC Global Equity Climate ChangeFund of Fund and Axis global equity alpha fund of fund.

DSP World Energy Fund and DSP World Gold Fund also fall in this category which invest in avenues for which sufficient investment alternatives are not available in India.

There are some advantages of investing in a Fund of Fund:

- Underlying funds, based on expertise of underlying fund managers and market dynamics, are chosen by fund management team of an Asset Management Company. I feel this is true only for those FOF who have invested in schemes of other asset management companies as well.

- Investors are guaranteed equitable NAV. All investors are given same NAV for a particular day, whatever is the amount for investment and whether it’s a buy or a sell transaction. Here I am not using fair NAV but using equitable NAV. We will come to this later in the article.

- By investing in Fund of Funds, we can take international exposure which provides diversification to the portfolio. These FOF saves retail as well as HNIs to take the complicated route of opening a foreign bank account, sending money through Liberalized Remittance Scheme, paying retail spread of currency conversion, filing complicated tax returns and estate duty in case of death of unitholder. Please note, these funds also pay spread but being institutional investors, the spread is very miniscule.

- These FOFs also offer thematic opportunities not available in India. For example, exposure in World Energy Companies, Gold mining companies, etc.

There are two sides of a coin, here are the disadvantages:

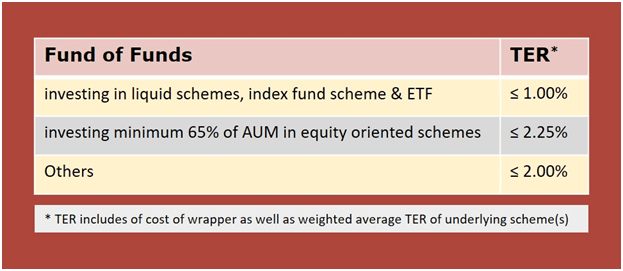

1. Additional cost for wrapper. The total expense ratio for FOF are subject to following limits:

Fund of Fund

Did you know?

All non-FOF schemes of anAsset Management Company “cumulatively” cannot invest in schemes of the same AMC or other AMCs more than 5% of the total assets of the Mutual Fund (it is not 5% at individual scheme level, it is at AMC level)

2. Different Valuation methodologies adopted by different AMCs to calculate the day end NAV of Fund of Fund. We will discuss this along with point 2 of advantages later in the article.

3. In case you have invested in a FOF which invests either fully or a part of their AUM in any category of debt schemes, please remember, in case of a credit event, the segregated part of the portfolio will only be reserved for the FOF and not for the ultimate beneficiaries i.e. unit holders. Recoveries in segregated portfolio will be shared to the unitholders of FOF on the day of recovery and not on the day of segregation. You can refer to the example of Franklin India Life Stage Fund of Fund – 50’s Plus Plan, in this fund, the segregated portfolio of Vodafone idea is there, and the recovery proceeds will be given to those investors of FOF which are holding units on the day of recovery.

Fund of Fund – FPA

4. Taxation is another disadvantage, so if someone is investing in a fund of fund which is investing all its money in active equity funds, like ICICI Prudential India Equity FOF is investing more than 97.85% of the net assets in equity orients mutual funds of either their own AMC or from those of other AMCs, but will be taxed as debt fund. More on taxation below.

Taxation for Funds of Funds:

It’s simple, yet a bit complicated. Below is the direct answer.

Only those Fund of Funds which invest greater than or equal to 90% of net assets in ETFs and these underlying ETFs also invest greater than 90% of their net assets in domestic equity, it’s taxed as an equity-oriented fund (t < 1-year, short term capital gains at 15% and for t > 1 year, at10% for gains greater than 1 lakh). In all other cases, FOF will get taxed as non-equity-oriented funds (means as debt funds, t<3 years at slab rate and for t>3 years at 20% post indexation).

Fair Valuation:

This is the heart of the article. Recently, there was a discussion on twitter between some of the most brilliant minds in the industry on valuation principles adopted by different AMCs to evaluate the date end NAV of Fund of Funds. Some of the AMCs are valuing their Fund of Fund on the basis of NAV of the underlying ETF and some are valuing on the basis of closing price of the ETF on exchange.

Now, it is absolutely perfect to value the fund of fund on the basis of NAV of the ETF, the problem starts in the closing price mode. Before going further, let me please highlight depth in these ETFs are not so great and any large order can affect the price in big way.

Just recently, Mirae AMC has disclosed the correct interpretation of the SEBI regulations that NAV of FOF is generally based on closing price of the ETF on the exchange but in case of exceptional circumstances where the valuation doesn’t look fair and reflective of its true price and in order to provide fair valuation to the investors, AMC can deviate and value the Fund of Fund based on ETF NAV with detailed rationale.Valuation Committee can take this call. Reporting has to be made to Board of Directors of the AMC and Trustees Company as well and a notice can be put on the AMC website.

Barring the exceptional circumstances in future, the NAV of FOF will be calculated using the closing price of the underlying ETF units on NSE & BSE.

I checked on the Eighth Schedule of the SEBI (MUTUAL FUNDS) REGULATIONS, 1996 which talks about Investment Valuation Norms.

-

- Traded Securities shall be valued at the last quoted closing price on the stock exchange This is what a lot of AMCs follow.

- The valuation of investments shall be reflective of the realizable value of the securities.

Here I think, the closing price of an ETF cannot reflect the realizable value as it can be manipulated as there is not much depth in the Indian Market for ETF trading.

- The Valuation Policy of the AMC shall describe the process to deal with the exceptional events where market quotations are no longer reliable for a particular security.

This is the most relevant point where AMCs must describe in their valuation policy that in case of a significant variation of the NAV and the closing price on exchange of ETF, they will consider NAV and not the closing price of the ETF for valuation of FOF. Rather I should say, they should always consider only and only NAV of the ETF for valuation of all Fund of Funds.Mirae AMC has recently shown this can be done.

This is what can happen if AMC remains rigid to value the FOF only on the basis of closing price of ETF and the cost will be borne by the “not so Smart” unit holders of the FOF.

Let’s say there is an investor, big investor, who is also smart enough to exploit these types of anomalies in regulations which allow AMCs to value Fund of Funds on the basis of closing price of underlying ETF. For the time being let us also assume that this investor is holding a decent position (say INR 1 Crore worth), in underlying ETF. This investor can manipulate and benefit from this anomaly at a cost which will be borne by rest of the unitholder.

Mr. Big Smart will transfer a big amount (let’s say INR 20-30-40 Crore) into the bank account of Fund of Fund for fresh purchase of units, well before the cut off time, submit the application of purchase with the AMC office (duly time stamped within cut off time). This investor will get the units allotted at a price (NAV) which is based on the closing price of the ETF.

So, let’s think of a way where Mr. Big Smart can manipulate the closing price of the ETF.

On the same day, on which he has applied for the units of Fund of Fund for INR 20-30-40 Crore, at 03:29:58 Mr. Big Smart will punch in a limit order to sell his ETF units (worth ~ INR 1 Crore) at a price which is 10% lower than the current price.

The End.

Yes, manipulation is over!

(here timing of order is crucial, it has to be seconds before the close of market)

How?

This Mr. Big Smart lost close to 5-10 lakh rupees by selling his INR 1 Crore worth of units at a price 10% lower than the current market price but on the other side of coin, he will get allotment of units for INR 20-30-40 crore, at a NAV which will be close to 5-10% lower than the fair NAV of ETF.

Now, Mr. Big Smart will not stop here, after few days, he will give the redemption application to the AMC, for unitswhich he has recently bought, worth INR 20-30-40 Crore and again at the auspicious time of 03:29:58, he will punch in one more order on the exchange, this time, a buy order, worth INR 1 Crore, at a price 10% higher than the current price.

I don’t think, I have to explain again to the intelligent readers, what will be the implications.

Mind you, all this profit which this Big Smart investor will make, cost of this will not be borne by the AMC, rather, it will be borne by the rest of the unitholder of the FOF.

The article will go big in length, otherwise, I wanted to write on the NAV declaration time as well for the schemes investing in US equity (a lot of FOF does that). I like the fair methodology used by Franklin AMC. Instead of same day 11 PM principle, to negate the different time zone thing, Franklin AMC declares the NAV of their Franklin India Feeder – Franklin U.S. Opportunities Fund on the next Business Day by 10.00 a.m. for the previous day.

Learn how to pick the right Equity & Debt Mutual fund through our online training module – FPA Workshop

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Courses

Nothing in this article should be constructed as investment advice; readers are advised to consult their advisors before making any investment decisions.