Employees’ Provident Fund – Understand it better

Nishant Batra – Research Head

62326821, this is not an eight-digit landline number. This number represents the number of contributing members in Employee Provident Fund Organization during the last one year. We all understand some of the features of Employee Provident Fund, but for some of the rules, either we are not clear or we are not aware. In this article I will try to discuss in detail many of the major aspects related to EPF.

History of Employee Provident Fund:

In compliance with the essence of the “Directive Principle of State Policy” as mentioned in the Constitution of independent India, the need for a robust social security cover resulted in the legislation of the Employees Provident Funds & Miscellaneous Provisions Act 1952 (EPF Act), as an endeavour to provide a life of dignity for the private sector employees and their dependents once they ceased to earn their normal livelihood. It provides major long-term savings scheme for these employees.

In 1976, to extend the benefits of life insurance, the government introduced the Employees Deposit Linked Insurance Scheme (EDLI) as a part of the EPF Act. The core benefit of the EDLI Act is, the registered nominee receives a lump-sum payment in the event of the death of the person insured, during the period of the service.

In November’1995, another scheme was introduced namely Employees’ Pension Scheme (EPS).

We will discuss all these schemes and much more in detail.

Applicability threshold

For Employers

All establishment with 20 or more employees (applicable threshold) comes under the preview of Employees Provident Fund and Miscellaneous Provisions Act 1952. It is regulated under the purview of Employees’ Provident Fund Organisation (EPFO) which is one of the largest Social Security Organizations in the world in terms of number of subscribers.

Organizations with less than 20 employees can also get themselves registered with EPFO.

For Employees

An employee with a salary (Basic + Dearness Allowance, throughout this article I will use Basic instead of Basic + DA) greater than INR 15,000 and who has never been a member in the scheme can choose not to become member. But once an employee becomes a member, he/she cannot opt out of the scheme. For employees with basic salary of less than INR 15,000, it is mandatory for them to become a member of the scheme.

The employee does not have the discretion to choose which of the three schemes, EPF, EPS or EDLI, he/she want to select, these three schemes comes in one bundled package.

Contribution Structure

The Employees Provident Fund is the fund pooled by both the employees and their employers. It is focused towards retirement and post retirement income.

Employees are required to contribute 12% of their basic salary. Employers also make 12% contribution of employee’s basic salary.

Of the employer’s 12% contribution, an amount equal to 8.33% of the salary is allocated to the employee’s pension fund (subject to a maximum of 1250) and the remaining amount (3.67%) is allocated to the Provident Fund. The employee’s entire contribution of 12% is allocated to the Provident Fund. The accumulated balance in the Provident Fund earns interest at a specified rate, which is announced by the government from time to time.

The employer also contributes for Employees Deposit Linked Insurance Scheme (EDLI).

Contribution Structure Employees Provident Fund

Apart from contribution if EPF, EPS and EDLI Scheme, the employer also contribute PF Admin Charges of 0.50% the basic subject to a minimum of INR 75/month for non-functional establishment having no contributory member and INR 500/month for other establishments. Over the years, these charges have reduced, from 1.10% to 0.85% in 2015 and from 0.85% to 0.65% in 2017. Effective 01st June, the charges have reduced to 0.5% of the basic.

Employees don’t have the option to unbundle the three schemes for opting but who stops us to unbundle them to understand the features of these schemes. Let’s start with the main bucket, Employee Provident Fund.

Employees Provident Fund

This is the main bucket where corpus gets accumulated for the purpose of retirement. It gets contributions from Employee and Employer both. Employee contributes 12% of the Basic salary and employer contributes 3.67% of the basic & and 8.67% (over and above INR 1250 which gets contributed in Employees’ Pension Scheme).

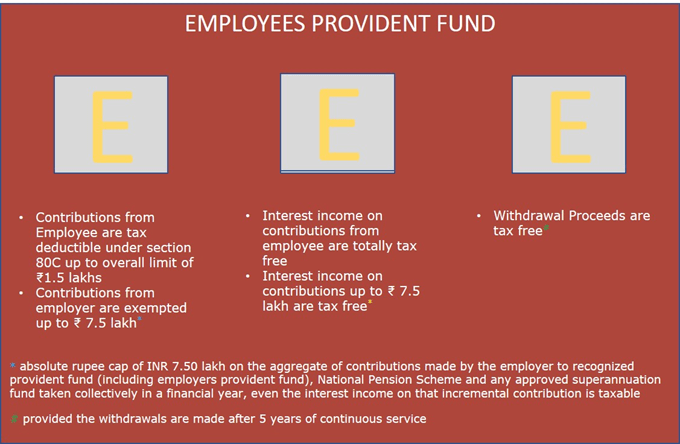

This scheme has EEE Status. Below images explains it in totality.

Employees Provident Fund

Contributions from employees are eligible for deduction under section 80C. Employer’s contributions are not eligible for deduction under section 80C. Here few things are noteworthy, contribution made by the employer to the employee’s provident fund account accustomed to be totally free of taxes in the hands of the employee without any absolute rupee amount limit provided the contribution does not exceed 12% of the basic salary. However, the Finance Act, 2020 has spoiled the party and modified the rule to put absolute rupee cap of INR 7.50 lakh on the aggregate of contributions made by the employer to recognised provident fund (including employers provident fund), National Pension Scheme and any approved superannuation fund taken collectively in a financial year. In case the employer contribution in recognised provident fund (including employers provident fund), National Pension Scheme and any approved superannuation fund goes above INR 7.50 lakh, even the interest income on that incremental contribution is taxable.

The employer shall pay both the contribution payable by himself (employer’s contribution) and also, on behalf of the member employed by him (employee’s contribution, deducted from the employee’s salary) within 15 days from the close of every month. If the employers make default in the payment of contribution to the fund, damages will be payable by the employer. After realising the dues, the PF members will be given full interest for each due month as if the employer has never defaulted and the employer shall be charged penal interest (to cover the interest payable to his employees) and penal damages (kind of penalty). In case the employer gets bankrupt, EPF dues have priority over any kind of debt.

In case the employer doesn’t deposit the dues, EPFO has the rights to attach the bank account, realise the dues from the debtor of the employer, attachment and sale of properties. EPFO can also get the employer attested.

As per New Wage Code, which will be applicable from 01st April’2021, an attempt seems to have been made for harmonization and simplification in defining the basic salary for eligibility of various social security related benefits like contribution to provident fund, gratuity and leave encashment. The new definition of basic pay will cap other allowances at 50% of total compensation implying that take home salary will decrease but retiral benefits in the form of higher gratuity and contribution towards PF will increase.

Let’s look at the history of interest rates of employee’s provident fund over the years. For the year gone by (FY 2019-20), 8.5% of interest has been announced and soon member’s accounts will be credited with the same. History of rates, for remaining years is below in the picture.

Provident Fund

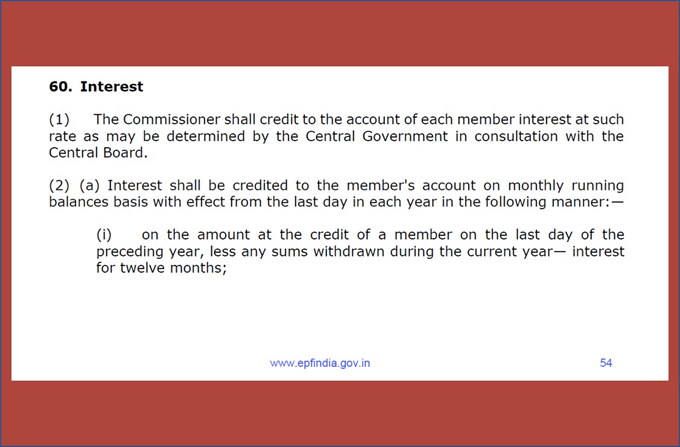

It is also important to understand how interest is calculated. Interest is calculated on monthly running balance at a rate determined by the Central Government in consultation with the Central Board.

I will take some time here on interest rate and date of credit of interest rate in member’s account.

News are doing the rounds that EPFO will credit the interest for FY 2019-20 in one go in coming days (date of writing this article is 03rd January’202), many financial experts believe it will affect the compounding (I also believed the same until I read below clause)

Provident Fund

Clause 60 (2) (a) says, Interest shall be credited to the member’s account on monthly running balances basis with effect from the last day in each year…….”

I read in blogs of some of the most respected financial experts that delay in credit of interest rate affects compounding and bring the overall CAGR down.

I asked one decently experienced labour law specialist attorney, he was not able to give clear answer.

Finally, I decided to make my own hands dirty. I calculated the interest applicable for FY 2018-19 in my own EPF Statement. Interest was credited on 17th January’2019 for FY 2017-18. To match the interest for FY 2018-19, I have to consider the “value date” for this interest as 31st March’2018 to match the credit of FY 2018-19.

Conclusion: Date of Credit of interest in EPF Account doesn’t affect the annualised return notified by the EPFO.

Fun Fact: A member can opt out to receive interest by informing the commissioner in writing, interest shall not be credited to the account of said member. If, however, the member subsequently asks for interest, it shall be credited to his account with effect from the first day of the financial year in which he makes a request to start the interest again.

Under certain conditions and for pre-defined purposes, members are allowed to make partial or complete withdrawal from the scheme:

For the purchase/construction of house/flat/plot with following conditions:

- the member has completed five years’ membership of the Fund

- the maximum permissible withdrawal is least of these three:

- in case of ready to move in flat/house, thirty-six months equivalent of member’s basic + DA & in case of plot twenty-four months equivalent of same.

- balance standing in the EPF account including employee’s and employer’s share of contribution including interest.

- the total cost of construction

- In case of flat/house/land, the payment will be made directly to the seller (and not to the member), in one or more instalments & in case the withdrawal is for construction, the payment will be made to member in such number of instalments as the official deems fit.

- In case of withdrawal for the construction house, the construction shall commence within six months of the withdrawal of the first instalment and shall be completed within twelve months of the withdrawal of the final instalment.

- In case the withdrawal is sanctioned for the purchase of house/flat/land, the purchase must be completed within six months of the withdrawal of the amount (not applicable for under construction houses)

- The ownership may be with the member or by the spouse or jointly.

For the purpose of repayment of loan obtained for housing with following conditions:

- the member has completed 10 years membership of the Fund

- the payment will be made directly to the lender

- the maximum permissible withdrawal is least of these three:

- thirty-six months equivalent of member’s basic + DA

- balance standing in the EPF account including employee’s and employer’s share of contribution including interest.

- the total loan outstanding (principal and interest).

For illness with following conditions:

- no minimum years of membership in the fund is required

- the maximum permissible withdrawal is least of:

- thirty-six months equivalent of member’s basic + DA

- balance standing in the EPF account including employee’s and employer’s share of contribution including interest.

- Medical criteria, for member or family member of the member:

- hospitalisation lasting for one month or more, or

- major surgical operation in a hospital, or

- suffering from T.B., leprosy, [paralysis, cancer, mental derangement or heart ailment]

For marriage of self, children or siblings or post-matriculation education of children with the following conditions:

- the member has completed 7 years membership of the Fund

- the maximum permissible withdrawal is 50% of balance standing in the EPF account including employee’s and employer’s share of contribution including interest.

- A maximum of 3 advances are admissible under this head.

Under abnormal conditions with the following conditions:

- no minimum years of membership in the fund is required

- the state government declared that an Act of God has affected the general public in the Area and the member has applied for advance within 4 months of such declaration.

- Movable or Immovable asset of the member has been damaged due the Act of God for which State has also declared.

- the maximum permissible withdrawal is least of:

- INR 5,000, or

- 50% of the balance standing in the EPF account including employee’s and employer’s share of contribution including interest.

- Special provision for advance was introduced to fight the COVID 19 pandemic, maximum permission withdrawal limit increased to three months equivalent basic of the member or 75% of the balance standing in the EPF Account, whichever is less.

For withdrawal within a year of retirement with the following conditions:

- Member age should be greater than 54 years or, the retirement is schedules within one year, whichever is later.

- the maximum permissible withdrawal is 90% of the balance standing in the EPF account including employee’s and employer’s share of contribution including interest.

Under all these heads which are discussed above for withdrawal, income tax is not applicable on any advance.

Circumstances in which full amount standing to his credit can be withdrawn:

- On retirement, after the age of 55 years. In case of resignation and not retirement, the employee has to wait for a period of 2 months.

- On retirement due to mental or physical infirmity, certified by the registered medical practitioner.

- Immediately before migration from India for permanent settlement abroad (it includes taking employment abroad).

- If the employee has opted for Voluntary Retirement Scheme

EPF Corpus is Ring Fenced

No judicial authority can attach the EPF Corpus to make good any overdue loan or any legal liability due to what so ever reason. EPF is not the only social security instrument which enjoys this kind of immunity, PPF and NPS also have same provisions.

EPF to NPS

PFRDA allows transfer funds from EPF to NPS. At this moment EPF is offering 8.5% tax free returns and all the funds can be withdrawn at maturity. In case of NPS, 40% of the corpus has to be used in buying annuity. On the other hand, NPS do offer the option of higher equity. NPS can be extended till member turns 70, whereas EPF can be continued as long as the member is working. In normal case, if member retires at 58, so at 61, the account will stop earning interest. I consider EPF as one of the best retirement options, if you can make tax free 2.6%, tax free, over and above the 10-year bond yield. Having said that INR 50,000 extra deduction on NPS should also be availed. EPF to NPS , one word answer, NO.

Read more about NPS here.

Voluntary Provident Fund:

Voluntary Provident Fund, as the name suggests, it is the voluntary contribution from the employee in his own provident fund. This contribution is over and above the statutory 12% of the basic. An employee can contribute up to 100% of his basic. Interest rate remains the same as that of EPF. VPF also enjoys EEE status. Contributions are tax deductible in overall limit of 1.5 lakh under section 80C. In the accumulation stage, interest earned is also tax free. At maturity, the proceeds are also tax-free.

VPF is a side cart to the EPF Account. Bike and the side cart will travel together on the same road and same traffic rules will apply to both. All the rules, like 5 years minimum contribution (otherwise withdrawals become taxable), withdrawal for different conditions is also applicable.

Hello HNIs, you have your own company, you can define your own salary, you can design your own salary structure, it can have 100% of the salary as Basic Salary. Why don’t you start buying these tax-free bonds yielding 8.5% by adjusting your payroll? Even if the contributions from company’s side increases 7.5 lakh limit, then also, tell me which sovereign bond is available at 8.5% without any interest rate risk.

Random If and Buts

When an employee changes his job, he should necessarily get his PF account transferred to his new employer. If an employee works with more than one employer, he can have two separate accounts (under the same UAN) and in future the employee can get the accounts (from where the employee has resigned) merged with active one.

If the claims, complete in all respects submitted along with the requisite documents shall be settled and benefit amount paid to the beneficiaries within 30 days from the date of its receipt by the Commissioner. If there is any deficiency in the claim, the same shall be recorded in writing and communicated to the applicant within 20 days from the date of receipt of such application. In case the Commissioner fails without sufficient cause to settle a claim complete in all respects within 20 days, the Commissioner shall be liable for the delay beyond the said period and penal interest at the rate of 12% per annum may be charged on the benefit amount and the same may be deducted from the salary of the Commissioner.

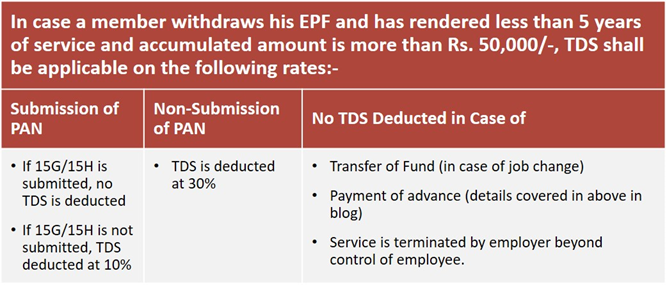

In case an employee withdraws the accumulated corpus without five years of continuous service, TDS will be deducted. Below chart explain it.

Provident Fund

Trick: your EPF Account will keep earning interest at 8.5%. If you can defer the withdrawal till the time five years of continuous service (with any number of employers) then withdrawals will become tax free.

If in an account contribution have not been made for three years after retirement or permanent migration abroad or death of the subscriber, it is classified as Inoperative account. Interest will not be payable in inoperative accounts of members aged 58 years and above.

Employee Deposit Linked Insurance

The core benefit of the EDLI Act is, the registered nominee receives a lump-sum payment in the event of the death of the person insured, during the period of the service. Key word here is during the period of service.

In brief explanation:

- As stated earlier, EDLI is bundled with EPF, there is no requirement of enrolling for this scheme separately and all EPF members indubitably come under the umbrella of EDLI. No exclusion of any member, all members are covered till the time he is an active member of the EPF.

- Consider this as a term plan with variable sum insured (which mainly depends on remuneration of the member). The premium of this term plan is paid by the employer.

- No threshold for length of service to be eligible for this scheme.

- Age, health conditions, lifestyle habits, nothing matter, all members are covered.

- Minimum Assurance Benefit shall not be less than INR 2.5 Lakh and the assurance benefit shall not exceed INR 7 lakhs.

Steps of calculation:

-

- Average Monthly basic salary drawn during the 12 months preceding the month in which the member died. Let’s say X (0<X<15000)

- Multiply the amount X by 30. Let’s say result is Y

- Calculate, average balance in the EPF Account, during the 12 months preceding the month in which the member died or during the period of membership, whichever is less subject to maximum of INR 1.5 Lakh. Let’s say Z

- Add Y and Z.

I am unable to understand the increase in maximum assurance benefit in September’2020 from INR 6 lakh to INR 7 lakh as X (maximum of 4.5 lakh) and Y (maximum of 1.5 lakh) are adding up to INR 6 lakh only. I will update the article.

Employee Pension Scheme

Similar to EDLI, employee doesn’t contribute towards this scheme.

Employer’s contribution equivalent of 8.33% of the basic, subject to a maximum of INR 1,250. In the case the 8.33% is less than 1,250, the government also tops it up by 1.16% of the member’s basic salary. Maximum contribution in EPS remains at INR 1,250 even if both employer and government contribute.

- A member become eligible to

- superannuation pension if he has rendered eligible service of 10 years or more and retires on attaining the age of 58 years

- early pension, if he has rendered eligible service of 10 years or more and retires or otherwise ceases to be in the employment before attaining the age of 58 years.

- the amount of monthly superannuation pension or early pension, as the case may be, shall be computed in accordance with the following computation:

Members’ Monthly Pension* = (pensionable service X Pensionable Salary)/70

* members’ monthly pension shall be determined on a pro-rata basis for the pensionable service up to the 1st Sept’2014 at the maximum pensionable salary of INR 6,500/month and for the period thereafter at the maximum pensionable salary of INR 15,000/month.

- Please note, EPS funds doesn’t earn any interest. In case an employee has worked less than 10 years, he has the option of withdrawing EPS funds. Withdrawal amount will be based on Table D (maximum basic salary is capped at 15,000 for this computation).

- Apart from withdrawing the amount, the member can get a scheme certificate issued, indicating pensionable service. Length of the service is rounded off. 2 years 5 months 20 days will be considered only 2 years and 2 years 6 months will be considered 3 years.

Employee Pension Scheme

Looking at the current regulations, please don’t depend on this pension for your retirement need. Even if you work for 40 years, the maximum pension that you will be able to get is

(40 X 15000)/70 = INR 8570/month (approx.)

This amount, that too 20-3- years from now, will be not enough!

An important question which members should keep in mind.

Is this interest rate of 8.5% for FY 2019-20 sustainable?

Answer is NO. Lets understand it by way of simple arithmetic calculation.

Government of India, 10 Year bond is currently trading at less than 6%.

85% of the assets are in fixed income, out of which close to 50% is in government securities. If I assume, yield of 7.5% on this 85% of corpus, equity has to deliver return of approx. 14% to take the weighted yield to 8.5%

But, let’s make hay while the sun shines.