In personal finance, not committing “catastrophic” mistakes has a huge role in creating wealth. Basically, most of these are traps, set by insurance agents, bank relationship managers and service providers (like insurance companies, credit card companies, banks, etc.).

I have written some interesting articles, but this article will bring the highest “utility” for all my readers and followers. By avoiding these mistakes, a lot of money can be saved and can be used for wealth creation.

A lot of columns, blogs and books have already been written on this topic, yet I want to give a new perspective for all my readers.

This topic is for everyone, whether you manage your money yourself or through your advisor, and for some of the advisor as well, it will go a long way in managing your finances.

Article will be detailed and I will classify it in five sections:

- Life Insurance

- Health Insurance

- Long Term Goals

- Retirement Planning

- Short Term Goals

LIFE INSURANCE

NOT TAKING ADEQUATE LIFE INSURANCE

Neighborhood LIC Uncle will act as messiah and will recommend you one of the products with highest commission. Here highest commission is not in percentage terms but in absolute rupee terms. Term insurance have the highest commission in percentage terms but as the premium is small, absolute commission in Rupee terms is not significant.

So, in traditional insurance plan, life cover is generally 10X of the annual premium. Even if you are contributing lakh, 2 lakh or 3 lakh per annum, Life Cover will not be sufficient to provide adequate corpus to fulfil the financial loss of the family. Rule Number 420, never ever buy traditional plans as they do not provide enough cover.

MIXING INSURANCE AND INVESTMENTS

The primary function of insurance company is to protect a probable loss. Why probable, it means the event may or may not happen in the period of coverage. The time and amount of loss are also uncertain. In the absence of insurance and at the happening of event, the person will bear the loss himself.

By taking insurance, we agree to pay a certain sum in return of a promise that if a certain event happens, insurance companies will make good the losses or pay a pre-defined amount.

This is purely a service for “transfer of risk”, from insured to insurer.

For the last many decades, traditional insurance products have been sold by playing with the psychologically of human mind. Let’s make the structure opaque and provide some money back to the insured. He will never know what went towards risk cover and what went towards investments.

Due to opaque and high cost, returns have remained sub-par.

Government and regulators have not questioned this practice as a big portion of these savings are invested by insurance companies into government securities which helps government in their borrowing programme.

Personal Finance

TERM PLAN WITH RETURN OF PREMIUM

This is a very innovative idea from insurance companies. Those who cannot be sold traditional plans due to their awareness, let’s pitch this option and play with their human mind. I will explain this and next few mistakes with numbers.

I have calculated sum insured for Rupee 1 crore for a male, non-tobacco user born on 01st Jan’1985. Policy Term 39 years (till the age of 75 years), the regular premium (payable every year for policy term) is INR 22,157 per annum (inclusive of GST). We will refer this as Base case through-out the article.

All these premium calculation in this article are done from leading, listed, private sector life insurance company.

If policy holder dies in the policy term (provided premiums are paid regularly and policy is in force), insurance company will pay INR 1 crore to the nominee. But in case the policyholder survives the policy term, insurance company will not pay anything to the policy holder.

Now, let us change the situation, that in case the policy holder survives the policy term, insurance company will pay back all the premium paid over 39 years by the policy holder. It effectively means, insurance company is just earning time value on premiums. Let us calculate the premium from same insurance company for this same person with “Return of Premium Option”, the premium comes out to be INR 42,670, an increase of INR 20,513 per annum.

Please note, only the basic premium will be paid back on survival of policy term. Taxes on premium will not be paid back.

Let’s now wear the cap of an analyst and compare:

- Total Premium payable at the end of 39 years will be – 15.92 lakhs

- Let’s assume a person has not taken this option and has invested the incremental premium in a conservative investment earning 6% tax free, the future value would be ~ INR 23,54,112

- In case the policy holder dies mid-way in policy term, the incremental premium is nullified and nominee will only get INR 1 Crore, which is the same as in base case.

- One last thing, what is the present value of INR 15.92 lakh after 39 years at 6% inflation. It is INR 1.64 lakh only.

In short, it is an advance version of a traditional insurance plan.

TERM PLAN WITH LIMITED PAY

In the base plan referred above, the policy holder is supposed to pay regular premiums every year for complete policy term.

If you are taking the policy online through web aggregator or directly through insurance company, please please please be mindful of mis-leading advertisements.

Like what?

Personal Finance 101 – Common Mistakes

If you are going to click this option, a new window will pop-up with a message

Save 43 % (? 3,75,823) by paying INR 48,830

ANNUAL PREMIUM FOR 10 YEARS

Incl Taxes & Levies as applicable

I hope saving 43% was so easy, just click on a button and believe in simple mathematics of a leading insurance company.

My analyst cap is already on my head, let’s compare:

-

- Premium

- payable for regular pay (base case) is INR 22,157 × 39 = INR 8,64,123

payable for limited pay (in this case 10 years) is INR 48,830 × 10 = 4,88,300

wait wait, it looks like, we can save money, advertisement is not misleading.

- That is because we have studied trigonometry but not time value of money in school.

- Let us now, calculate the present value of both streams of cash flows at same discounting rate of 6%. Present Value of regular pay is INR 3,51,100 and for limited pay is INR 3,80,957 time value of money would have been a better subject than trigonometry. QED.

- One more big difference is recovery of premium, in first 10 years, in limited pay, insurance company has recovered 10 out of 10 premiums vs. 10 out of 39 premiums in regular pay. So, in case the claim gets triggered in 11th year, limited pay option is at disadvantage.

- In limited pay option, insurance companies offer options from single pay to 5 years to 10 years. The lesser the payment term, the bigger will be the set back. Agents will propose only limited pay with 10 years, it is something to do with commission calculation. Commission in single pay is very low and keep increasing till 10 years payment term.

TERM INSURANCE WITH LIFE COVER UP TO 99 YEARS

For making a comparison of this option, I have to change the life insurance company as the previous one is not offering this policy. This insurance company is also listed.

One crore, male, 01st Jan’1985, non-tobacco user, policy term 39 years, premium is 32,456

One crore, male, 01st Jan’1985, non-tobacco user, policy term 63 years, premium is 48,550

Looks like, life cover till 99 years (36 + 63) is a decent option, pay 16 odd thousand extra per annum and one crore is almost guaranteed, after all what’s the probability of living beyond 99 years of age.

The cap is on:

-

- In all probability, the claim is going to get triggered, so in later part of the policy, we should treat it as investment plan and not term insurance. Look, when money is almost guaranteed to come back, then how can this remain transfer of risk, it becomes an investment. It is only for later part of the policy.

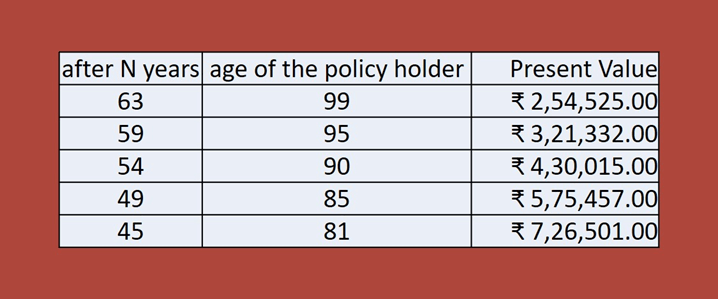

- First some house cleaning, present value of 1 crore, at 6% inflation, refer below image. So in later years, the Sum Insured, in today’s purchasing power is not significant. Lakh pati ka zamana ja chuka hai crore pati ka chal raha hai aur jald ji arab pati ka shuru ho jaayega

Personal Finance 101 – Common Mistakes

- So, let’s leave this purchasing power thing aside and let’s calculate the annual SIP amount at 6% annualized return for accumulating INR 1 crore in 63 years. The magic number is INR 14,784 per annum, paid in the starting of the year. This amount is less than premium differential between 39 years policy term and 63 years policy term. And if I assume for slightly higher return of 9%, considering the time frame, investor can go in equities, the differential premium will need only 46 years, 7 more than 39 and 17 less than 63. So, investing the differential would make more sense.

PAYOUT OPTION

While taking term plan, you can opt for payout options and configure how your nominee receives the claim payout i.e. lumpsum, regular income and a combination of lump sum and regular income.

In this option always choose lumpsum. As in regular income option, nominee will get the same sum insured without any interest but in tranches. So your money will lose, time value of money.

To make sure your family do not mismanage the money in poor investments/speculation/frauds, one can argue to choose a payout option that pays small amounts in the tranches.

I would rather say, you should guide them, today, that they can simply put their money in fixed deposit a nationalized bank and withdraw as per need. Not telling this, and your insurance company will keep that interest of fixed deposit and will pay them regularly irrespective your family need the money or not.

This was all about zindagi ke baad bhi

Let’s now consider, zindagi ke saath bhi

HEALTH INSURANCE

NOT GIVING ALL INFORMATION BY MISTAKE

Insurance is a complex set of promises on a pre-condition that insured has given all the information correctly in the proposal form. On the basis of this information, insurance company’s underwriting team decides whether to give insurance or not, at what price to give insurance cover and other important things.

Sometimes, while filling up the insurance form, the person may miss some crucial information, although that omission is un-intentional but insurance company can reject the claim or cancel the policy in future (at the time of claim, when insurance company discovers the omission).

So, fill your proposal form carefully.

HIDING MATERIAL INFORMATION INTENTIONALLY

If unintentional omission can become a reason for rejection of claim or cancellation of policy, I need not explain much that hiding something intentionally can also lead to same consequences.

RELYING SOLELY ON MEDICLAIM PROVIDED BY EMPLOYER

One should not rely solely on Mediclaim provided by employer, as the sun insured is not enough (generally). When you switch jobs, the gap between the relieving date and new joining date is also not covered. Not only switching jobs, there can be termination from employers’ side as well. So in the unemployment period, there will be no coverage. Aise mein kuuch ho gaya to, ek to job ki tension, phir hospital expenses. Soch lo.

When you retire, at that age taking new health insurance policy will have its effect on waiting period. By that time a lot of pre-existing diseases will also be there in body.

Insurance is not like this:

Jab zaroorat hogi tab le lenge, insurance company befkoof nahi hai, zaroorat mein nahi underwrite karegi.

Some of the corporate policies comes only with co-pay option.

NOT UNDERSTANDING THE BENEFITS AND LIMITATIONS OF POLICIES

Complex set of promises, understanding the promises will set the right expectations, that is what insurance is. Room Rent, Co-pay, capping, etc. Understand everything to the T.

MEDICLAIM WILL NOT COVER EVERYTHING

In case of a claim, Mediclaim will not settle 100% of the bill amount, there may be items which the insurance is not covering and the same needs to be paid by the insured. Better to have some medical emergency fund in place for such contingencies.

LONG TERM GOALS

Although Retirement is also a long-term goal, but I will cover mistakes make in retirement separately.

NOT DEFINING THE GOALS

A financial goal has to be defined, in money terms with a timeline. For example, I want to buy a car. It is not a financial goal, it doesn’t define car of what value and when. In Januar’2025, I want to buy a car which costs 10 lakh rupees today. This is a financial goal. Now, one can plan for it.

PLANNING IN NOMINAL TERMS

All the long-term goals have to be planned after accounting for inflation. Look at the graph below, INR 1 lakh in held in hard cash today, at 5% inflation, 20 years down the line will loose purchase power by more than 62%

Personal Finance 101 – Common Mistakes

Not only inflation, one should also consider taxation as well and make plans on net real terms.

PLANNING TAXATION

I am intentionally keeping this point short, as explaining it in detail will require a lot of space and attention and can be done in a dedicated topic only.

In brief, one should try to take benefit of capital gain-harvesting (applicable to only long term on equity) which revolves around using the Nil tax window of INR 1 lakh.

One should also, take maximum benefit from los harvesting.

I am giving it a jump for inter head, intra head. Set-off, carry forward and on time return filing requirement.

GOALS SHOULD BE REALISTIC

Setting unrealistic goals is just the beginning of a journey which ends with disappointment.

I want to buy a brand-new Mercedes S class, I can save 10,000 per month for 6 months with zero savings in hand. This goal is unrealistic. I want to plan for my retirement, 20 years away, I am assuming portfolio returns to be 15% annualized. This goal is also unrealistic as assumption of return expectation is not fair.

Here is an example for realistic goal, I want to plan for retirement, will invest X amount to achieve Y corpus, in 20 years (age after 20 years will be 56 years), at 9% return expectation and if at the end of 20 years, I fall short of achieving Y corpus, I will defer my retirement by 1 or 2 years to fund the deficit.

Learn how to pick the right Equity & Debt Mutual fund through our online training module – FPA Courses

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Courses

RETIREMENT

STARTING LATE, (WILL ALLOCATE HIGHER IN LATER YEARS)

Let’s look at the formula, for compound interest

Amount = Principal (1 + rate)time

Mathematically speaking (I mean writing), “time” is going to influence the results much more than the “rate”.

Ok, I will provide you the illustration as well.

Person “A” starts at the age of 25 years and contributes ? 10,000 per month for her retirement goal. “A” saves for next 35 years till she reaches 60 years of age.

Person “B” starts a bit late at the age of 35 years and contributes ? 15,000 per month for his retirement goal. “B” saves for next 25 years till he reaches 60 years of age.

Both earned same 10% CAGR

Personal Finance 101 – Common Mistakes

Person “B” contributed, 5K extra (this 5K is basically 150% of “A” contribution) each month for 25 years and still……. Leaving this for my readers to assess.

DEPENDING SOLELY ON EPF

Contributions to employee provident fund (here I am assuming zero contribution to VPF) coupled with pension from EPS will not be enough to create enough retirement corpus to live on.

EPF is an exceptionally good investment vehicle to plan retirement, only limitation is, more savings are required to create adequate retirement corpus.

I have written a detailed article on EPF, you can read it here.

DEPENDING SOLELY ON NPS FOR GOVERNMENT EMPLOYEES

EPF is available only for private sector employees and government employees who have joined after 01st Jan’2004 are by default covered under National Pension Scheme. Again, same story, great product, but it alone will not be able to suffice adequate corpus. More savings are required.

I have written a detailed article on NPS, you can read it here.

ASSUMING YOUR CHILDREN WILL HELP YOU OUT

It’s a good thing to inculcate life values in your children, but depending on those values in special years, just go out and listen the stories of senior citizens living in old age homes.

SELF EMPLOYED – ALLOCATING EVERYTHING IN EQUITIES AS GOAL IS LONG TERM

Self-employed do not have the privilege of contributing in EPF (generally), and are lazy enough to open NPS account. At the most what they have is PPF account. Rest of the retirement planning is done either in Mutual Funds, Fixed Deposits or direct stocks.

Those who do not have the taste of equities stick to FDs but those who venture in equity, specially after understanding the concept of compounding and how equities have the potential to deliver inflation beating returns in the long run, allocate a lot more (sometime all) towards equity and eventually are not able to digest the volatility and end up selling the holdings in market panic.

NOT UTILISING ADDITIONAL 50K TAX EXEMPTION OF 80CCD(1B), NPS

Let’s say X has Annual Income post adjustment of all exemptions, deductions and everything of (INR X + 50,000) and this INR 50,000 falls in 30% tax bracket. If X doesn’t invest in National Pension System, the tax outflow will be INR 15,000. After this tax outflow, X will be left only with INR 35,000. On the contrary, if X decides to invest in National Pension Scheme and claim deduction under Section 80CCD(1B), he would have saved tax of INR 15,000. It means, X has to forgo liquidity of only INR 35,000 to invest INR 50,000 worth of contribution in NPS Tier I Account. On day 1, X has earned 42.85% (15K/35K) of return. That’s an awesome return which provides cushion to ride through most severe of market crashes. The number of 20% tax bracket and 10% tax bracket is 25% and 11.11% respectively. Thing here to be noted is I have not considered Health & Education Cess of 4% which will make the case more appealing to invest in National Pension Scheme. In case of assesses with income greater than INR 50 lakhs even surcharge will come into picture and make the case even stronger.

Those who are not comfortable with annuity part at the maturity of NPS, please note, these tax savings will fund your annuity for free. Any doubts!!!

Withdrawing retirement corpus for other goals

EPF and PPF both have the options of withdrawing certain corpus for certain pre-defined situations. I understand, when money is required, better to withdraw money from these baskets when compared to taking loan. But, plan for different life events, be it construction of house, child education/marriage and take health insurance to cover hospitalization cost. Planning for different life events will ensure that these retirement semi-locked in wallets are not touched.

Same applies for corpus, demarked for retirement in financial products without lock-in. be it Fixed Deposits or open-ended mutual funds.

One more common folly which I have observed is people withdrawing EPF in between the jobs and not transferring it.

Banks and willing to fund all other financial goals but not retirement, always keep this in mind.

LETTING THE BANK RM SUGGEST PRODUCTS FOR RETIREMENT

RM is suggesting product to fulfil his target and not your retirement. “He” or for this case, let us include “she” as well, is more concerned about bonus/incentive/target than your retirement. If you want to check, just go into the leading private sector bank and pretend you want to open PPF Account. You will be straight away, with a smiling face, offered an insurance product.

Let Banking remains banking and use this channel for loans, making and receiving payments (domestic and international) and cards (debit, credit and forex).

LIFE INSURANCE CUM INVESTMENT PRODUCT AFTER RETIRMENT

You will be wondering, this insurance cum-investment thing has been covered in term insurance. Yes, it is covered. BUT, it needs to be said again. Why?

There is a particular reason, yes, this article is about common mistakes, so it is a common mistake.

Generally, at the time of retirement, a decent amount gets credited in the bank account, on account of provident fund, superannuation fund, gratuity & leave encashment. Your Bank RM keeps an eye on the large debit/credit in the account.

Chances of mis-selling are very high at this point, careful please.

GIFTING THE RETIREMENT CORPUS TO YOUR CHILDREN

Quoting a dialogue from the movie Baghban

ek baap agar apne bete ki zindagi ka pehla kadam uthane mein uski madad kar sakta hai … toh wahi beta apne baap ke aakhri kadam uthane mein usse sahara kyun nahi de sakta?

Just like the other points in the article, I can write three four lines for this as well, but I would like my readers to watch this video

https://www.youtube.com/watch?v=2WhlUy7u2cU

SHORT TERM GOALS

BUYING VOLATILE ASSETS (EQUITY) IN GOALS WHICH ARE JUST AROUND THE CORNER

Nobody knows, what will happen in the short term, and if an unfavorable event happens in the short term, for a goal which is around the corner, you will not be able to give your investments enough time to grow.

Taking the funds marked for short terms goals lightly, especially when the funds are available.

TAKING PERSONAL LOANS OR REVOLVING CREDIT CARD BALANCE

Not planning the financial goals properly will lead to a situation where you will be requiring the funds immediately for which there are not enough savings to back.

To fund the goal, credit card limit is used and when balance is not paid on time, issuer starts charging chakrvati byaaj.

Similarly, personal loans can dent your finances and must be taken with caution, I will say, must not be taken.

- Term Plans can also be aligned to goals, for example, a 35-year person who is also saving for daughter’s marriage, planned after 20 years, should take a term plan equivalent to goal amount with policy term ending with the goal timeline. If the person survives, he would have saved for the goal and once the goal is accomplished, no need for risk cover equivalent to goal amount. Similarly, for a goal which is only 15 years away, take a term plan with policy period of 15 years only. This way a lot of premiums can be saved.

- Salaried employees can consider taking term cover up to 60-65 years of age and self-employer can consider up to 75 years of age. In any case no need to go beyond 75 years of age.

- Never ever compare the returns of a ULIP plan with that of a mutual fund. In the ULIP plan only one expense has been taken care of i.e. management fees. ULIP plan NAV has not accounted for premium allocation charges, mortality charges and policy administration charge. These charges are deducted by extinguishing units of the policy holder.

- Make a will for all assets, financial and physical. Appoint matching nominee for all your financial assets. Give complete information about all assets. If you are excluding any legal heir as beneficiary, mention this specially in the will. Appending a medical certificate by the doctor vouching physical and mental health AND self-hand-written will can avoid a lot of disputes. Sign on all pages and get it signed by witnesses as well, on all pages.

- If you have dependent parents, make sure they also have enough funds in case something happens to you. They should not be dependent on your wife or children.

- Do not venture into option trading specially by buying out of money options in hope of a favorable move.

- This is very subjective, but try to avoid investing in direct stocks, it will give you a lot of adrenaline rush but there are times, when investors get struck averaging down in a large cap stock and destructing a lot of wealth.

- Always diversify, not among mutual fund schemes or stock names, but first in different asset classes. Start with adding Gold and Global Equities.

- Focus on savings and try to reduce discretionary expenses if important life goals require more allocation.

- While making credit card payment, make sure, you are paying the full amount, private sector banks websites and mobile apps, have a trick here as well, by default only the minimum amount is check marked. Careful! Better go for auto pay.

Learn how to pick the right Equity & Debt Mutual fund through our online training module

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – https://fpa.edu.in/courses.aspx

Nothing in this article should be constructed as investment advice; readers are advised to consult their advisors before making any investment decisions.