Nishant Batra – Research Head

In this article, I will write in detail about IPOs, regulations around IPO, IPO funding, Anchor Investors, Shareholder Quota, Retail Quota, grey market and some more.

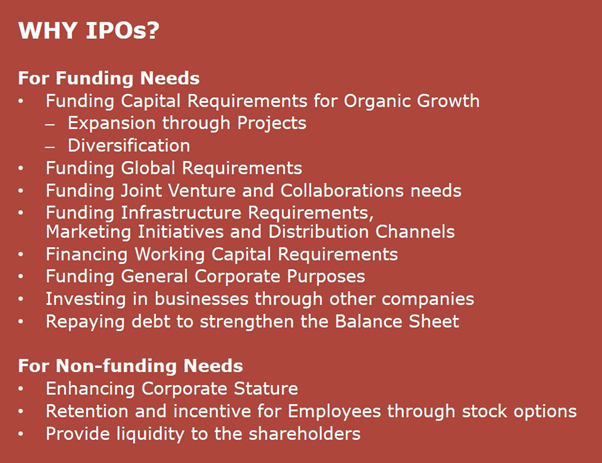

Reasons may be different for large and small corporations to raise funds but reality is everyone need funds. Some may need the funds as seed capital to start a business and other may need the funds for working capital. Reasons for funding may range from survival to killing to the competition, from research and development to taking business to new markets or in new segments. Funding can be either in the form of loan/credit (debt) or in the form of profit sharing (equity). Here we will focus only on fund raising through IPO.

Initial Public Offer

Major Sources of Equity Financing

1. Angel investors

Angel investors are High Net-Worth Individuals who purchase stakes in a young or small business ventures, providing funds and resources for start-up or expansion. Along with the money, these individuals bring business skills, experience, and connections to the table, which helps the company in growth and expansion.

2. Crowdfunding platforms

If you have watched enough Shark Tank episodes, entrepreneurs many a times told the Sharks that they have already raised money on “Kickstarter” or “Indiegogo”. These are crowdfunding websites. Crowdfunding is where a number of people contribute (in the form of debt, equity or donation) small amounts of money to the business or proposed idea. This funding can be reward based, debt based, equity based or donation based. An equity crowd funder invests money in return for shares, or a small stake in your business, project or venture.

3. Venture capital firms

The venture capital is also termed as private equity finance. Venture Capital firms are a group of investors who invest in businesses they think will grow at a rapid pace and will appear on stock exchanges in the future.

4. Corporate investors

Corporate investors are companies with decent size that invest in private companies to provide them with strategic resources and necessary funding. The investment is usually to exploit potential synergies between the two businesses.

5. Initial public offerings (IPOs)

Companies that are more well-established can raise funding with an initial public offering (IPO). The IPO allows companies to raise funds by offering its shares to the public for trading in the capital markets.

All stakeholders including employees, venture capitalists and promoters would had put their blood and sweat in making the company successful enough. The company would have paid their employees in the form of ESOPs. When the company goes public, it is the time when these stakeholders start plucking their fruits of labour in the form of liquidity available on these stocks.

Learn how to pick the right Equity & Debt Mutual fund through our online training module

Process of Initial Public Offer

An IPO could be structured for any of these two reasons:

fresh funds to finance its expansion and diversification plan. This will increase the share capital of the company as fresh shares will also be issued.

Exit for existing investors. Only existing shares change hands. It is also known as Offer for Sale (OFS).

Generally, it is a combination of (1) and (2) i.e. some fresh shares are issued and some existing shares are offered.

Step 1: Appointment of Investment Managers

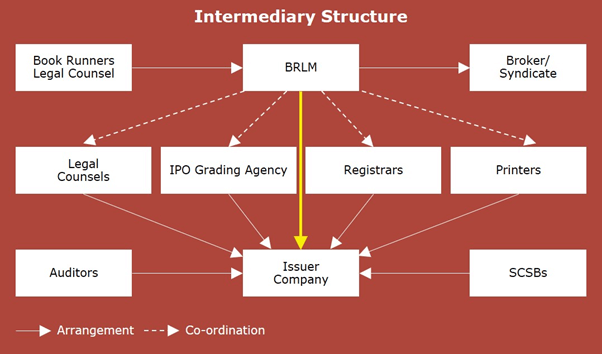

The first step is the appointment of the investment managers, more popularly known as Book Running Lead Managers (BRLM).

The investment bank is selected on the basis of company’s prior relation with the bank, reputation and track record, quality of research, industry expertise and distribution strength.

The mandate for investment banks is to get the best price from the market. and get investors to buy the IPO. Issuers want to make sure about the success of IPOs (as they spent lot of efforts and money in professional fees and marketing) so they negotiate underwriting terms with investment banks or through a third party for a fee.

The following underwriting arrangements can be done:

Firm Commitment: Under this kind of agreement, the underwriter gives guarantee to the issuing company that entire issue will be subscribed in the IPO. The underwriter purchases the entire issue and resells the shares to the investing public on a spread. The underwriter assumes full financial responsibility for any unsold shares.

Best Efforts Agreement: Under such an agreement, the underwriter does not have any obligation to purchase the unsubscribed shares. Underwriters receive a pre-decided fee for the services provided for their efforts (read: best efforts) for selling the issue. Underwriter’s risk is eliminated at the cost of any potential for profit which could have accrued in case of firm commitment.

All or None Agreement: As the name suggests, if all of the offered shares are not subscribed, the issue is cancelled.

Syndicate of Underwriters: Generally, no single investment bank would like to assume the full risk and thus, it forms a syndicate which includes other merchant banks. The bank which leads the pack is known as lead manager.

Step 2: Preparation of DRHP and submission with SEBI

After the selection of investment banker and agreement on underwriting, the next step is to prepare a draft prospectus (knows as Draft Red Herring Prospectus, DRHP) and submit the same with SEBI. This document covers extensive details about the company’s business so far, including the financials, its plans for the future, competitive scenario in its industry and how it plans to use the funds generated from IPO.

The regulator reviews the DRHP from the point of the view of the interests of the investors at large and raises objections over any part of the plan that is not in line with the interests of the investor and/or the integrity of the capital markets.

Once the SEBI issues “observation” which mean the IPO has got regulatory approval, the next step is to file the Red Herring Prospectus (RHP). This is the document which investors are required to go through in detail to take a call on investing decision.

The issuing company files various versions of the prospectus from the initial stage to the final stage. Once the IPO bidding is closed, the company has to submit the final prospectus to both Registrar of Companies and Securities and Exchange Board of India. This final prospectus will contain the quantum of shares being allotted along with the price of allotment of shares.

The company also files with the exchanges where it plans to get listed.

Step 3: Creating a buzz and doing road shows

After the “observation” (read: approval) from the regulator, companies make their IPOs like the producer and the cast market their movie.

Management of the company and lead managers conducts investors meet and brokers meet to pitch the IPO to retail and HNI Investors. IPO is also showcased to potential institutional investors. Management and Lead managers also visit key financial centres across the world like Singapore, London, Hong Kong, New York to showcase the offering to global investors.

Step 4: Pricing

After the regulatory approvals are in place and the company is ready to launch the IPO, it files an updated version of the prospectus which contains the relevant dates of the IPO and few days before the subscription period price is disclosed. The company has the option of fixed price issue vs. book building issue. In fixed price issue, there is only one price band vs. in book building issue there is a price band and investor can choose any price within that price band or the cut off price.

Step 5: Allotment to Anchor Investors (optional for the issuer)

This concept is introduced by SEBI in 2009, Anchor investors are qualified institutional buyers who are offered shares in an IPO a day before the offer opens for general public. As the name suggests, these investors ‘anchor’ the issue by agreeing to not to sell the shares for atleast 30 days from the date of allotment and subscribe to shares at a fixed price so that other market participants can know that there is demand for the shares. The minimum application size for this category is INR 10 Crore and minimum allotment (which is discretionary) is INR 5 crore.

Although this step is optional for the issuer company, but issuing shares to anchor investors just before the IPO is open for general public reenergises the popularity of issue.

Step 6: Bidding through book building

After finalizing pricing and allotment to Anchor Investors, the IPO is made available to investors for bidding. Generally, IPOs are kept open for at least 3 working days and can be extended in case of undersubscription. An IPO can be kept open for a maximum of 10 days.

The IPO market timings are from 10.00 AM to 5.00 PM. At the request of the Book Running Lead Manager, the session timings can be further extended on the last day of bidding process.

Few things are noteworthy here, any type of application can be revised or withdrawn during the bidding period. Non-QIB Applicants can also withdraw their applications after the bidding period is over by writing a letter to the Registrar any time before finalisation of the basis of allotment of shares by the company.

Step 7: IPO Allotment

Registrar to the issue has the responsibility to ensure the credit of shares in the successful respective applicants demat account. Allotment process, is explained extensively later in the article.

Step 8: The D day

The IPO process come to a crescendo on the day of listing of the company on stock exchange. On the listing day, the applicants who got the allotment can sell their shares and new or existing investors can purchase.

There are multiple parties involved in the successful listing of the IPO, below image gives just a glimpse of the parties involved:

Initial Public Offer

Let’s now dwell into the process of allotment in various categories.

Process of Allotment

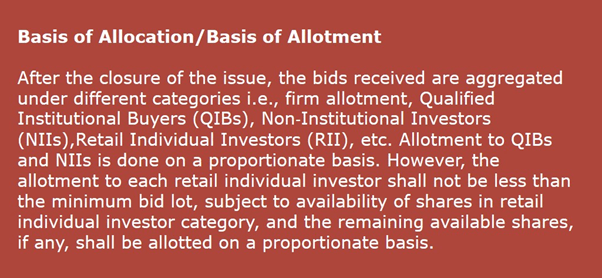

Before the allotment of shares, all invalid bids that were incorrectly submitted are eliminated from the total number of bids to come to the final number of successful bids. At this point onwards, we will only talk about successful bids.

In Retail Individual Investors category, I will discuss the allotment process in two circumstances, oversubscription and undersubscription.

Retail Individual Investors (RIIs):

First some housekeeping.

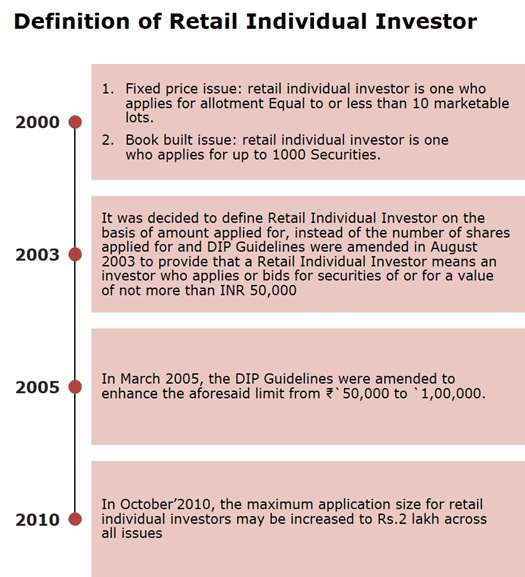

This category is for retail investors which as per SEBI are those investors who applies or bids for shares of not more than INR 2,00,000 in an IPO. Resident Indian Individuals, NRIs and HUFs can apply in this category provided application is less than or equal to INR 2 lakhs.

Initial Public Offer

Investors of all categories are required to bring in 100% of the application money as margin along with the application for applying in the IPO, this money may have been raised externally but it needs to be there with the application.

The procedure of bidding in an IPO is not done randomly and one cannot bid for any number of shares he/she wants. The bidding is open in a predefined lot size which is decided by the issuing company but the minimum application amount (minimum lot size multiplied by IPO upper or lower price band) must not exceed or fall below INR 10,000 – INR 15,000.

The lot size is applicable only for IPO bidding and IPO allotment, once the shares are listed on the exchange, investors can sell their shares in market in any quantity.

Let’s also understand the difference between price bids and cut-off bids. If one has selected a specific price, investor conveys the message that he is willing in buying shares at that price whereas cut-off simply signifies that the investor is agreeable to buy at any price point within the price band.

As an example, in a price band of INR 100-105 per share, no bids below INR105 per share will be considered in allotment if the cut-off price is decided by the issuing company in consultation with lead manager is INR 105 per share.

Initial Public Offer

In case of oversubscription:

For Retail Individual Investors (RIIs), the process for the allocation of shares is bit tricky. As mentioned earlier, the maximum amount which the retail investors can apply for in an IPO is INR 2 lakh only and if the amount is greater than INR 2 lakhs, the application will not be treated in RIIs quota rather it will be treated in NIIs (Non-Institutional Investors quota, we will discuss this later in article).

In case, total number of shares applied exceeds the number of shares available in this category, the registrar will try to accommodate as many applicants as possible by issuing one lot only. In case, after allotting one lot each to all applicants, there is still shares available in the quota, those shares can be allotted proportionately. On the other hand, if the number of applicants are so large in numbers that allotment of one lot is not possible to each of them then role of lady luck comes in play.

In case of undersubscription:

In case, total number of shares applied fall behind the number of shares available in this category, all the applicants will get full allotment. Simple!

This is what happened in the IPO of DLF Limited in 2007, all retail applicants got full allotment. I do not track IPOs much, so was not able to mention any recent example.

Qualified Institutional Buyers (QIBs):

Qualified Institutional Buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets. These buyers can withdraw their bids till the time the bidding window is on but after the closure of bids, unlike RIIs, QIBs are not allowed to withdraw their bids.

If a QIB has subscribed as Anchor Investor, just a day prior to opening of the issue, the same QIB can again bid under the QIB reservation quota and the application will not be rejected on the grounds of multiple applications.

Allotment to these investors is proportionate. For example, if a particular QIB investor applies for 100 Crore of shares in an IPO which got over subscribed 20X in QIB category, then this QIB will get allotment of 5 crore worth of shares.

Non-Institutional Investors (NIIs):

Resident Indian individuals, Eligible NRIs, HUFs, companies, corporate bodies, scientific institutions, societies and trusts who apply for more than INR 2 lakhs worth of IPO shares falls under this category.

Just like QIBs, allotment to these investors is also proportionate.

Initial Public Offer

Now think about High Net Worth Investors, what option does they have to increase their allotment size. If they apply in RIIs quota in a decently oversubscribed IPO, the best possible outcome for them will be allotment of 1 lot. That 1 lot worth of shares on the portfolio level have negligible weightage and will not move the needle for a super HNI investor.

So, here comes the concept for IPO funding, financial institutions fund the application of HNIs in over subscribed IPO to increase their allotment size.

The Borrower opens a Designated Bank Account with a Lender’s preferred bank and a demat account. The Borrower then issues a Power of Attorney (PoA) granting all operational rights in the favour of the Lender for both bank account and demat account.

Depending upon the oversubscription, hype and demand of the IPO, the lender decides the rate of interest and margin from the investor. Generally, the rate of interest is in the range of 8-10% and margin in the range of 0.25% to 1.5%. SBI Cards IPO was an exception where rate of interest was in the range of 16%.

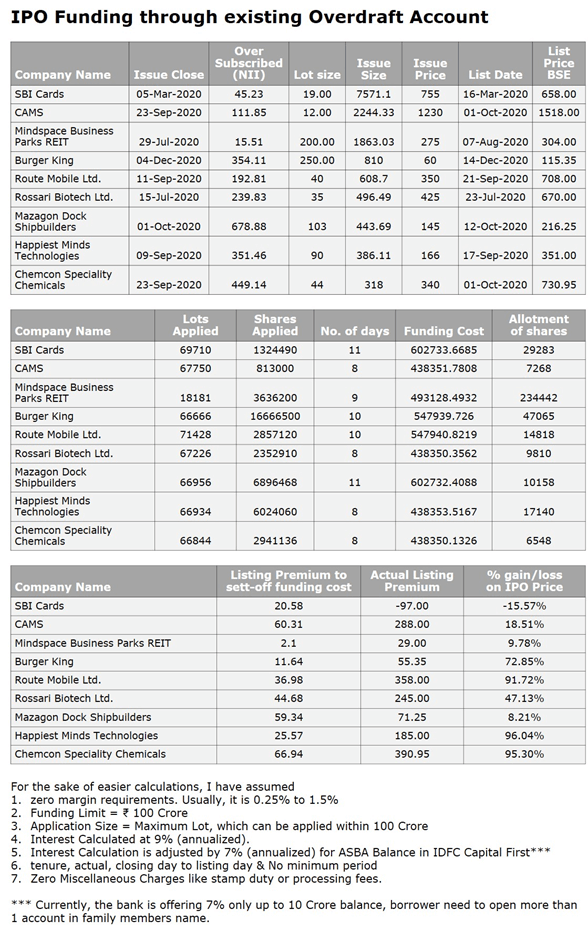

Look at the below table, I have considered some of the big IPOs of 2020 which have raised more than 300 Crore.

Look at the over subscription in Mazagon Dock Shipbuilders IPO, whopping 678X and premium on listing was 49%. Due to such a high response to the IPO, the allotment per unit of capital deployed came down significantly and this IPO required a listing premium of ~ 132% just to set-off the funding cost.

Initial Public Offer

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Course

Long story short, if you want to make money in leveraged IPO application after adjusting for the cost of funding then you need a fusion of reasonable oversubscription and ample listing premium. Otherwise, IPO funding is not as elementary as it appears to be, it eats away the major portion of listing gains.

Now, lets make some smart changes, where cost of IPO funding is much lower. These types of changes can only be possible in UHNIs portfolios. One needs to be ready even before the IPO by opening an Overdraft Account where collateral can be Mutual Funds or Stocks. If one has decent negotiation skills, this rate of interest can easily be settled at 8.5% (may be even lower). On the last date of subscription (provided the IPO is already decently subscribed), the applicant can transfer funds from OD account to IDFC Capital First Bank Account and then apply from there under ASBA (Applications Supported by Blocked Amount) mode. Money in the bank will keep earning 7% (annualised) and OD will keep charging 8.5% (annualised), net differential to client will be 1.5% only. This saving in Funding Cost will significantly bring down the required “Listing Premium to set-off funding cost”. Below chart calculates the return on this basis.

Initial Public Offer

Before jumping on to the grey market premium, let us also understand the allotment process in Shareholder’s Quota and Employee’s Quota.

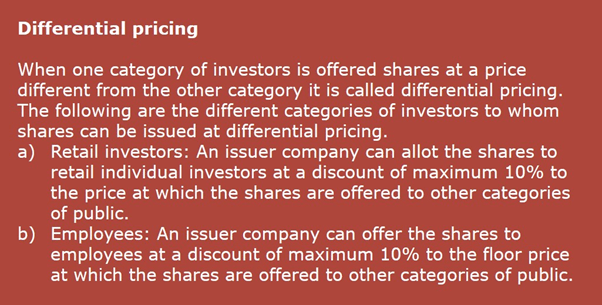

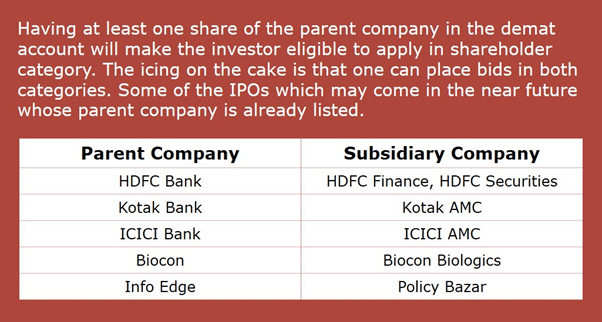

The reservation for both these categories is offered over and above the shares reserved for three regular categories (QIBs, NIIs, and RIIs). The aggregate number of shares in these three categories forms the core of the offer and is called “Net Offer”. Any shares offered to employees and shareholder of parent company are offered over and above this Net Offer.

To be eligible for employee quota, one need to be an employee of the company floating the IPO whereas to be eligible for shareholder category the applicant needs to be an investor in the parent company on the record date (the day company files RHP with the Registrar of Companies). Holding one single share in parent company is enough to be eligible for shareholder’s quota.

Initial Public Offer

Retail Individual investors can make two applications in such issues and both will be considered valid. However, one needs to be cognizant of the fact that both the applications should be less than INR 2 Lakhs. But if one is applying only in shareholders category than the application size can be to the limit of shares reserved in shareholders quota.

Initial Public Offer

Allotment in the shareholder’s quota is on proportionate basis.

Let’s understand allotment in Employees quota with the extracts from DRHP of SBI Cards:

Initial Public Offer

Grey Market

Investors usually watch the grey market premium before applying for the IPO. Let’s understand what this grey market is and what is grey market premium.

Grey Market for IPO is like a forward market which is not regulated and totally works on trust. In this over-the-counter market, deals are done in-person only among the closed trusted group of investors. These deals are usually facilitated by the broker in neighbourhood and are cash settled on the day of listing.

In the grey market, an investor (with huge counter party risk) could sell IPO shares or IPO application before the company gets listed on the stock exchange. The premium at which this deal happens with respect to the issue price of the IPO is called Grey Market Premium (GMP).

One can also sell the IPO application (irrespective of whether the allotment comes or not) for a fixed price, this rate is called Kostak Rate.

And in case the IPO application is sold in the grey market, subject to allotment only, the deal is called ‘Subject to Sauda’. In case the seller of the application doesn’t get allotment, the deal is nullified.

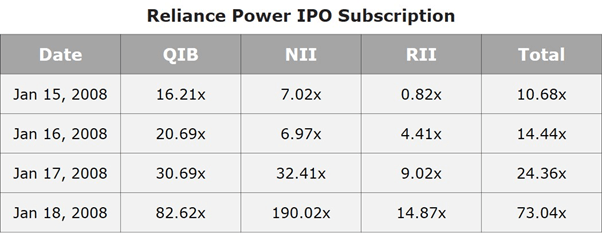

Now, lets come to the discussion, whether grey market premium should hold any significance in making the decision of invest or not to invest. The best example to understand the failure of grey market premium is to read the News Articles leading to Reliance Power IPO in 2008. As per my sources, all the dealers of Grey Market defaulted on listing of Reliance Power IPO. That is the type of counter party risk this grey market has, which is neither white nor black.

The IPO of Anil Ambani backed Reliance Power had generated bids worth over INR 7.5 lakh crore and the issue got subscribed by more than 72 times. Within the first few minutes, the IPO got fully subscribed. Issue price was INR 450 per share for non-retail investor and INR 430 a share for retail investor.

This IPO was graded GRADE 4/5 & IPO Grade 4 by CRISIL and ICRA respectively, indicating that the fundamentals of the issue are above average.

The market participants had huge expectations from Reliance Power IPO listing, the issue once had commanded a premium of up to Rs 550 a share in the grey market. But on the listing day, within first few minutes, 4 to be exact if I can recall it precisely, the issue was trading at discount to the issue price. This issue has the power of brand, reputation of the promoter, record number of shareholders and backing of institutions (82.62x) but the company never recovered after the first few minutes in which few FIIs and one domestic bank offloaded their entire stake, which was close to 10.5% of the total shares allotted in IPO.

Reliance Power IPO Subscription

In my opinion, Grey Market Premium is gibberish for retail investors. And retail should focus more and more on overall financial planning rather than speculating in IPOs on the basis of GMP and Oversubscription numbers. If we analyse the probability of allotment, allotment size (in the event of allotment), weightage in overall net-worth, risk, return, time, ITR filing and distractions these IPOs create for small retail investors, its not worth the efforts. Retail should focus more on holistic financial planning and work on skill development which can fetch them far higher returns in the form of increments, superior role and higher pay packages. I have no words to say for those retail investors who have subscribed for IPO Advisory services. By paying 4-5K yearly and tracking GMP and filing of RHP, Price bands, over-subscription figures, my vocabulary is short of words to describe this type of greed and foolishness of retail investors.

Some random facts and/or thoughts:

- Total of 4712 IPOs were raised in Financial Year 1992-93, 1993-94, 1994-95, 1995-96 and 1996-97 Vs. 1066 from 2000-01 to 2020-21 (up to 30th November’2020). Currently, approximately 4200 companies are active in BSE out of which many are penny stocks. A lot of listed companies have died, so whenever you hear a story of an IPO which has now become mega cap and has delivered multi-fold returns, just remember, this is nothing less than an example of survivorship bias.

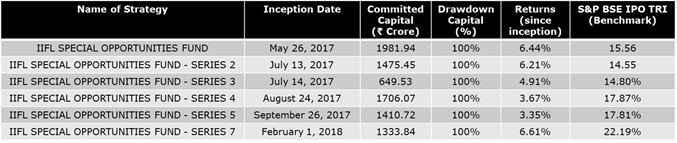

- Looking at the demand for IPO shares, IIFL launched a unique offering in the structure of Alternate Investment Fund named IIFL Special Opportunities Fund in February’2017. By March’2018, the fund-raised INR 8754 crore, one of the largest fund-raises by any AIF in India. IIFL launched multiple tranches of this strategy. IIFL raised the money in multiple legs in to complete one tranche, my concern here is even before raising all the legs of one tranche, it started issuing another tranche. Mandate of these tranches were to acquire shares of companies which are expected to come up with IPO in near future or acquire shares of companies in Anchor Investor Quota. Refer below table, these returns are post expenses and pre-taxes, in category II AIFs, taxations is passed on the investors. Below data as on 30th November’2020

Initial Public Offer

Edelweiss also came up with similar strategy. Edelweiss Crossover Opportunities fund and have delivered a CAGR of 3.78% on post expense, pre-tax and pre-carry basis, the inception date was 17th September’2017. Series II of same fund, inception date: 16th September’2018, has delivered a CAGR of 4.49% till 30th November’2020. Concentration in these two funds is very high, with single stock holding 32.8% and 25.6% in Series I and Series II respectively.

Series I also has exposure to Gangadi Investment private Ltd NCD SR3 (4.3%), which is not matching the investment objective of the scheme of investing in a portfolio of equity related instruments of listed and unlisted companies.

As the minimum investment in these funds is INR 1 Crore (Being AIF), I will not comment whether these funds make sense for HNIs or not, let their employees decide.

3. For new listing (if post issue capital is greater than INR 4000 crores @ issue price), the company may be allowed to go public with 10% public shareholding and comply with the 25% public shareholding requirement by increasing its public shareholding by at least 5% per annum till the time 25% public shareholding requirement is not reached.

Learn how to pick the right Equity & Debt Mutual fund through our online training module

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Course

Nothing in this article should be constructed as investment advice; readers are advised to consult their advisors before making any investment decisions.