Index Funds vs ETFS

Nishant Batra, Research Head

In this article, I will write about index funds and ETFs in easy to understand language and various other things one need to know about index funds and ETFs.

To start with, both these instruments comes under mutual fund umbrella.

Index Funds:

Index Funds are those pooled investment vehicles which replicate the portfolio of a particular index such NSE 50 TRI. These schemes invest in those securities which are there in the index these schemes are mimicking and that too in the same weightage. Net Asset Value of these schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same basis points. This difference leads us to tracking error and tracking difference. We will discuss the concept of tracking error and tracking difference later in the article.

One can buy and sell index fund at the day’s end NAV which is calculated based on the weighted average price of the constituents in the last 30 minutes of the day.

Exchange Traded Funds:

An Exchange Traded Fund, which unlike a normal Mutual Funds trades like a stock on exchange.The units of an ETF can either be bought and sold through a registered broker of a recognized stock exchange or through the Asset Management Company directly.

The live NAV varies as per market movements of the constituents and investor has the option to buy nearby these NAVs.

ETFs Vs Index Funds

- Applicable NAVIndex funds (open ended mutual funds) can be bought and sold only at the end of the day (EOD) NAV through AMC whereasETFs can be bought multiple times during one single trading day within trading hours at multiple prices near real time NAV or iNAV. Please note close ended mutual funds can be traded on exchange, but as on date there is no close ended index fund tracking any index in India.

- Expense Ratio vs. Total Cost of OwnershipExpense Ratio of ETFs is less than that of Index funds. But Expense ratio is not the only cost of owning an ETF. In addition to the expense ratio when you buy and sell the ETF you also pay the brokerage and other statutory costs like GST, Security Transaction Tax*,stamp duty, exchange fees and SEBI turnover tax.

*STT is not applicable on GOLD ETFs, LIQUID/Gilt ETFs and International ETFs.

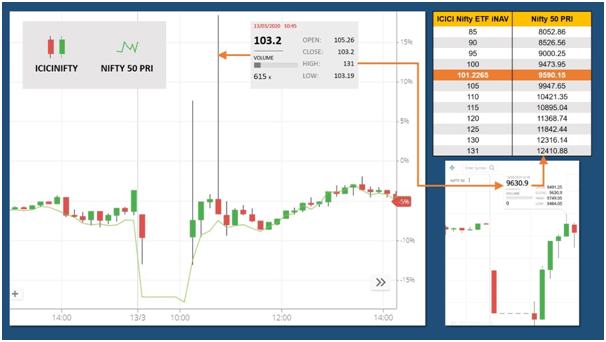

3. Bid-Ask SpreadAs stated earlier, index funds can be bought only at day’s end NAV whereas ETFs can be bought through out the trading day. ETFs, when bought through exchange, has the problem of bid ask spread, Generally, at any point in time, there are two prices for any listed security (except when security is in circuit), including the ETFs: the price at which someone is willing to buy that security (the “bid”) and the price at which someone is willing to sell that security (the “ask”). The difference between these two prices is known as “spread”, hence the terminology bid-ask spread. An ETF usually trades very closely to its NAV however, for some very-low-volume ETFs, bid-ask spreads may exist and can be a significant one. Trading ETFs with large spreads eats into the potential returns since they affect the acquisition cost and sale price. Illustration image below.

Index Funds vs ETFS

4. Traded Price ≠ iNAVNow comes the problem ofdifference in traded price vs the live NAV, look at the below image, this is ICICI Nifty50 ETF compared to Nifty 50 index, ETF was expensive by more than 2% in the first half of the trading hours and some innocent investorsbought the index at ~ 12410 levels at a time when index was at around 9600 levels. Nifty level on your app ≠ what you have paid for while purchasing the ETF.

Index Funds vs ETFS

5. Systematic Investment PlanIndex funds are convenient for those who are looking for disciplined investing over longer period of time as one can structure a systematic investment plan (SIP) in an index fund but not in an ETF. Also, the flexibility to trade an index like stocks also creates a temptation to trade, which can potentially increase the trading costs and tax outflow. Similarly, Systematic Withdrawal Plan and Systematic transfer plans are not available in ETFs.

6. Demat mandatoryDemat account is mandatory for ETFs whereas demat is optional for index funds.

7. Liquidity Liquidity for index funds (considering they are open-ended), is provided by the Fund House whereas liquidity for ETFs have a three-layer liquidity:

A. Visible secondary market liquidity

When buying and selling happen on the exchange during market hours and no additional units are created. This liquidity is directly proportional to the number of ETF unitholders and Assets Under Management.

B. Hidden secondary market liquidity

Authorized Participants also known as market makers dynamically manage the creation and redemption of ETF units through the Fund House to provide additional liquidity in the secondary market. These market makers provide liquidity by buying/selling ETF units and try to keep bid/ask spreads closer to the fair value of the ETF, which is represented by iNAV during the day. These market makers never create any unhedged position. Below image shows the creation and redemption process.

Index Funds vs ETFS

C. Primary market liquidity

The third level of liquidity is through the Fund House. Here, investors directly create or redeem ETF units (in minimum unit creation size). This provides large investors (institutional and HNIs) with seamless tap for redemption and creation of ETF units. When AMC receives a redemption request, it will extinguish the units and sell the underlying holdings. On the other hand, when AMC receives fresh inflows (in unit creation lots), it creates new units by buying the underlying securitiesof the index from the market in same proportion.

Tracking Error Vs. Tracking Difference

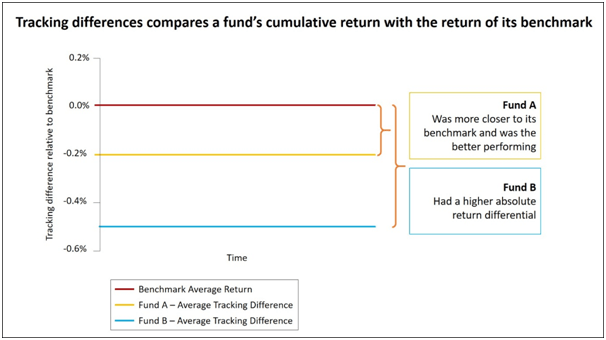

Knowledge is power, I have seen people using tracking difference and tracking error interchangeably, which is wrong. Tracking difference measures how an Index Fund or ETF has performed compared with its benchmark that it tracks over a specific period.

Tracking error points out the steadiness of a product’s tracking difference duringthat same time period. It is the annualizedstandard deviation of tracking differencedata points for the given time period.

While trackingdifference measures the degree to whichan index fund or ETF return differs from thatof its benchmark index, tracking errorindicates how much divergence existsamong the individual data points that makeup the index fund’s or ETF’s average tracking difference.

Below images depict the concept of Tracking Difference and Tracking Error

Index Funds vs ETFS

Index Funds vs ETFS

Here we have realized lower tracking error doesn’t equal to best replication of benchmark index. Long term investors will prefer a fund with higher tracking difference (tracking difference is negative, so in absolute value, lower tracking difference) whereas short term traders may opt for better tracking error over tracking difference. The best product will have higher ranking in both, tracking error and tracking difference.

In case Tracking difference or tracking error is positive, it’s a red flag, although investors made higher returns than benchmark, but it also signifies inability of the fund to replicate the index completely. Net of expenses, replication has to fall short in returns.

Reason for tracking difference and tracking error can be management fees of the fund/ETF, cash component in the portfolio, impact cost of underlying securities and inability of Indian Fund managers to buy partial shares. For example, if an index has 50 Stocks, and weight of stock A is 11%, price of Stock A is 834 and AUM of the fund is 500 Crore, to replicate the index completely, fund manager has to buy 6,59,472.42 shares. Here in India, the Fund Manager cannot buy partial shares.

Even a passive Fund Manager can play an active role in bringing down the tracking error and tracking difference by participating in reverse arbitrage opportunities and also by earning yield by lending the stocks in the portfolio.

Some random thoughts:

- In India, income from Stock Lending and Borrowing is passed on to the unit holders whereas in developed countries same is shared between AMC and unitholders.

- Tracking errors for ETFs should be measured using traded price and not NAV. The NAV is irrelevant for a small retail ETF investor who is buying from the exchange. That’s why retail should strictly stay away from ETFs and prefer index funds.

- Index Fund or ETFs fund managers are allowed to generate income on account of reverse arbitrage i.e. selling the stock in cash market and buying the future (available at lower price than cash market).

- There is an opportunity for smart investors in internationalindex funds/ETFs, the anomaly is due to different time zones. The NAV for theseIndex funds/ETFsis a combination of two data points – 1) End of day underlying security prices, here AMC (particular AMC only and for US indices) considers previous day closing prices. 2) Exchange rate: This will be as of 5 PM the same day. The NAV is declared post market hours just like any other mutual fund. Let’s say benchmark index futures are down 5%, smart investors can trigger a redemption before 3 PM to save 5 %. Yes, its so easy. Same applies for capturing the upside as well. This will increase the tracking difference as well as tracking error of the fund. On the other hand, Franklin AMC for their Franklin US Opportunities Fund declares the NAV on next business day by 10 AM to close this loop hole.

- HNI investors (non-US resident), sending their money through LRS so as to buy US listed low cost ETFs must be aware of three things a) cost of sending funds include, conversion charges, SWIFT Charges and your local bank’s transaction charges. b) same cost is applicable when you repatriate your funds back c) in case of an unfortunate event of death of the investor, amount greater than $ 60,000 is subject to estate tax which can be as high as 40%. We are not discussing tax on dividends.

- to avoid the estate tax discussed in 3 (c), one can take route of Ireland Domiciled ETFs. Consult your tax advisor, please.

- Investments done in ETFs listed in India doesn’t affect the LRS limit available of $ 250,000 per year.

- Although listed on exchange, international ETFs, are not taxes are ordinary equity shares listed in India, taxation for international ETFs is similar to non-equity oriented schemes.

- The AMCcan create or redeem units in unit creation size lots. For creation of unit investor can either totally in cash or in combination of “Portfolio Deposit” and a “Cash Component” which can be exchanged for corresponding number of units. Similarly, investor can opt for redemption in kind wherein the investor will receive the securities (in same weightage as in index) in his demat account and cash component in his bank account.

- Impact cost is the cost attributable to lack of market liquidity of underlying securities. Impact cost for small cap ETFs will be significantly more than impact cost of front like ETFs like Nifty 50.

- Bharat Bond and recently launched Nippon India ETF Nifty CPSE Bond Plus SDL-2024 are target maturity ETFs, tranches of these ETFs will cease to exists after their maturity dates.

- Leveraged ETFs are not permitted in India. However, Fubon NIFTY 2X Leveraged Index ETF is available in Taiwan Stock Exchange and Mirae Asset Tiger Synth-India Leverage ETF in Korean Stock Exchange.

- Inverse ETFs are also not permitted in India however, Nifty50 PR 1X Inverse is offered by Fubon Asset Management Taiwan.

- IDBI Principal was the first Indian Asset Management Company to launch an index mutual fund tracking the frontline index, Nifty. Later down the line it became Principal Nifty 100 Equal Weight fund.

- Benchmark Asset Management Company was the first to launch Niftybees – an exchange-traded fund tracking the Nifty 50. Benchmark was later acquired by Goldman Sachs India which was acquired by Reliance mutual fund which was acquired by Nippon.

Learn how to pick the right Equity & Debt Mutual fund through our online training module

Learn Financial Planning through the Certified Financial Planner (CFP®) certification from Financial Planning Standards Board (FPSB) – FPA Course

Nothing in this article should be constructed as investment advice; readers are advised to consult their distributors before making any investment decisions.